I think the author is taking a walk into the technical weeds here, but there is plausibility in his thinking.

What is actually in play here is a high-stakes effort to build up leverage and resources to manage America’s debt, reset its industrial base, and renegotiate its standing in the global order.

And it all begins with a problem most people have not been told enough about.

In 2025, the U.S. government must refinance $9.2 trillion in maturing debt. Some $6.5 trillion of that comes due by June. That is not a typo—that is a debt wall the size of a small continent.

Now, here is the math: According to Treasury Secretary Scott Bessent, each basis-point (one one-hundredth of a percent) drop in interest rates saves the government roughly $1 billion per year. Since the announcement of tariffs on April 2, 10-year Treasury yields have fallen from 4.2 percent to 3.9 percent—a 30 basis point drop. If that holds, it translates to $30 billion in savings.

So, keeping yields low is not just sound policy—it is a fiscal necessity.

But we are in a difficult environment. Inflation has not fully cooled, and the Federal Reserve remains wary of cutting rates too quickly. So the question becomes: How does one bring yields down without the Fed’s help?

Here is where the strategy becomes interesting.

By introducing sweeping tariffs, the administration is creating precisely the kind of economic uncertainty that drives investors toward safer assets such as long-term U.S. Treasuries. When markets are spooked, capital exits risk and equity assets (as we see with the stock market collapse) and piles into safe assets, primarily the 10-year U.S. treasury bond. That demand pushes yields lower.

It is a counter-intuitive move, but a calculated one. Some have called it a "detox" for the overheated financial system. And it appears to be working.

However, even cheaper debt does not solve everything. The deficit remains massive—and that is where spending cuts come in.

www.foxnews.com

www.foxnews.com

Here's what Trump is really up to with high-stakes tariff gambit

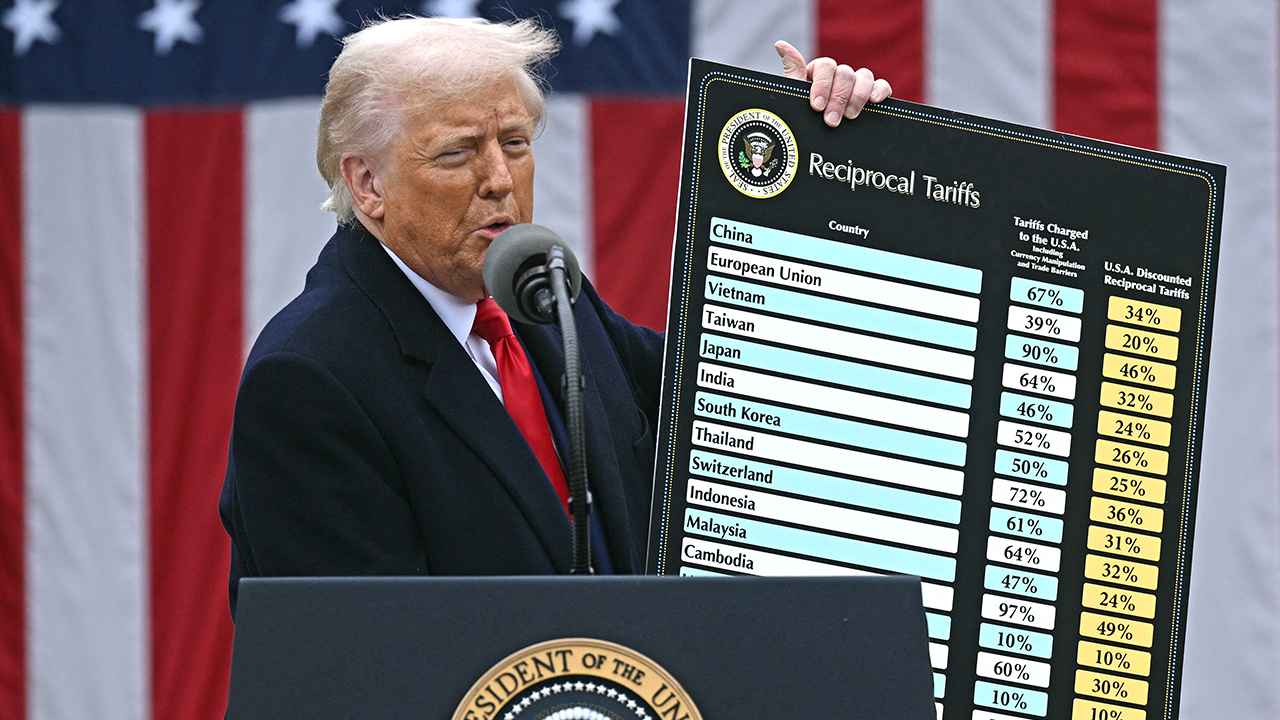

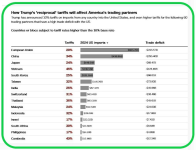

Let us be honest: When most people hear "tariffs," they think about price hikes and trade wars. But the Trump administration’s latest tariff rollout is not merely a knee-jerk protectionist move—it is part of a far broader strategy.What is actually in play here is a high-stakes effort to build up leverage and resources to manage America’s debt, reset its industrial base, and renegotiate its standing in the global order.

And it all begins with a problem most people have not been told enough about.

In 2025, the U.S. government must refinance $9.2 trillion in maturing debt. Some $6.5 trillion of that comes due by June. That is not a typo—that is a debt wall the size of a small continent.

Now, here is the math: According to Treasury Secretary Scott Bessent, each basis-point (one one-hundredth of a percent) drop in interest rates saves the government roughly $1 billion per year. Since the announcement of tariffs on April 2, 10-year Treasury yields have fallen from 4.2 percent to 3.9 percent—a 30 basis point drop. If that holds, it translates to $30 billion in savings.

So, keeping yields low is not just sound policy—it is a fiscal necessity.

But we are in a difficult environment. Inflation has not fully cooled, and the Federal Reserve remains wary of cutting rates too quickly. So the question becomes: How does one bring yields down without the Fed’s help?

Here is where the strategy becomes interesting.

By introducing sweeping tariffs, the administration is creating precisely the kind of economic uncertainty that drives investors toward safer assets such as long-term U.S. Treasuries. When markets are spooked, capital exits risk and equity assets (as we see with the stock market collapse) and piles into safe assets, primarily the 10-year U.S. treasury bond. That demand pushes yields lower.

It is a counter-intuitive move, but a calculated one. Some have called it a "detox" for the overheated financial system. And it appears to be working.

However, even cheaper debt does not solve everything. The deficit remains massive—and that is where spending cuts come in.

Here's what Trump is really up to with high-stakes tariff gambit

Policy analyst Tanvi Ratna breaks down what President Trump is really up to with his tariffs, and it is more ambitious that you may think.

Conservative think tank. That's some funny, but dumb fake news there, halfwit.

Conservative think tank. That's some funny, but dumb fake news there, halfwit.