FUCK THE POLICE

911 EVERY DAY

http://krugman.blogs.nytimes.com/2009/06/13/way-off-base/

Way off base

Mark Thoma and David Altig both react to Arthur Laffer’s assertion that the increase in the monetary base presages huge inflation.

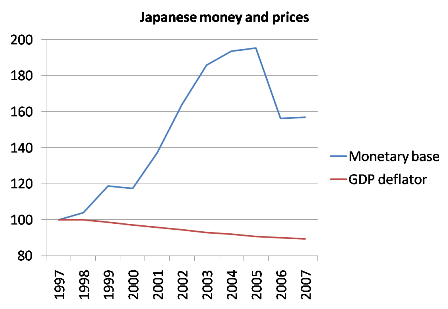

Let me add, for the 1.6 trillionth time, we are in a liquidity trap. And in such circumstances a rise in the monetary base does not lead to inflation. I had a couple of charts in my lectures this past week. First, Japan:

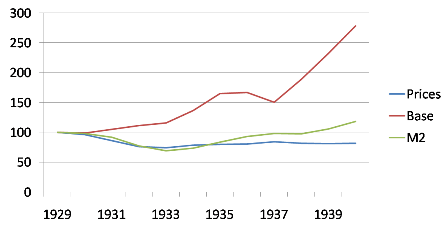

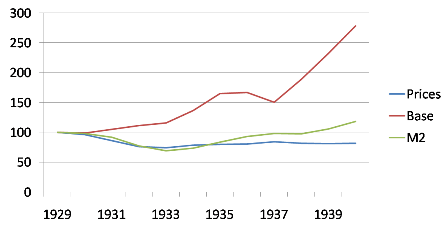

Next, America in the 30s:

Notice, in this case, that a Friedman-style focus on a broad monetary aggregate gives the false impression that Fed policy wasn’t very expansionary. But it was; the problem was that since banks weren’t lending out their reserves and people were keeping cash in mattresses, the Fed couldn’t expand M2.

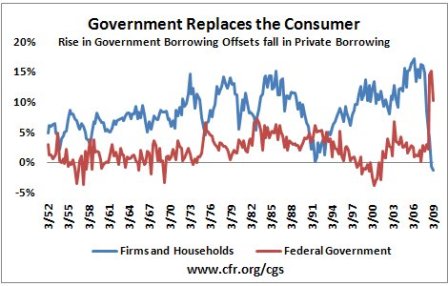

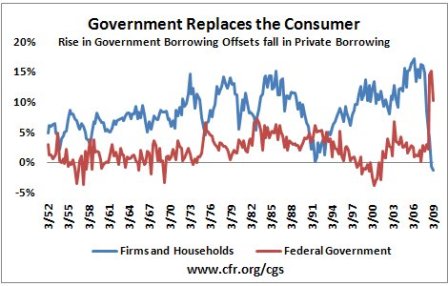

While I’m doing charts, the people at CFR have updated the borrowing picture:

Government borrowing, while huge, has not quite offset a huge plunge in private borrowing.

Way off base

Mark Thoma and David Altig both react to Arthur Laffer’s assertion that the increase in the monetary base presages huge inflation.

Let me add, for the 1.6 trillionth time, we are in a liquidity trap. And in such circumstances a rise in the monetary base does not lead to inflation. I had a couple of charts in my lectures this past week. First, Japan:

Next, America in the 30s:

Notice, in this case, that a Friedman-style focus on a broad monetary aggregate gives the false impression that Fed policy wasn’t very expansionary. But it was; the problem was that since banks weren’t lending out their reserves and people were keeping cash in mattresses, the Fed couldn’t expand M2.

While I’m doing charts, the people at CFR have updated the borrowing picture:

Government borrowing, while huge, has not quite offset a huge plunge in private borrowing.