Not likely. Gold is pretty stable. The 'swings' as you call it are not wild.

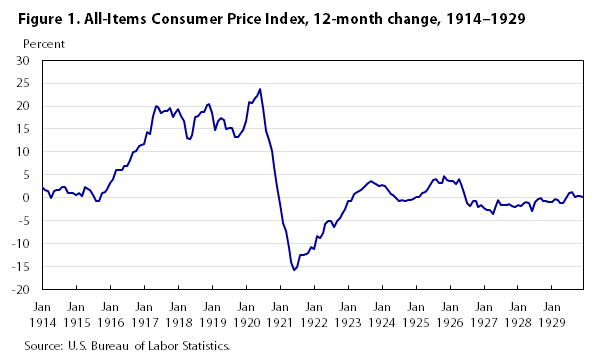

As you can see, in the 1920's we had a wild swing up to above 20%, and down to nearly 20% deflation. It happened several times in the 1800's too. Economists thought the wild swings would correct themselves with another wild swing, but there was also the possibility of a liquidity trap.

From 1930 to 1933, there was near constant deflation of 7% a year and higher. That was deflation of about a third, with no end in site.

Velocity is not value nor inflation. Velocity is not value nor deflation.

We can collect the current average velocity of money. Inflation and deflation are also values.

Deflation is NOT more destructive then inflation. In deflation, prices are lower.

Imagine you make $4k a month, and have a mortgage for $1k a month, leaving you with $3k a month to do everything else. Now deflation means you drop down to $2k a month income, but still have the mortgage of $1 a month. Your mortgage just doubled in value. Spread that over all the business loans and consumer loans, and you have a huge number of bankruptcies, especially banks.

If there is an expectation of deflation, people will save their money for the future when it will be worth more. They will not invest or spend their money, but merely put it under a mattress. This decreases the velocity of money, which increases deflation. It is a deadly self reinforcing cycle.

Nope. Gold doesn't 'sink to the center of the Earth'. It floats just like any rock.

Iron has a density of about 7.9 times water, so granite (2.7 times water) floats easily on it. Gold, at 19.3 times water, will sink into liquid iron. At the center of the earth is iron, and all the gold that was on the original, liquid Earth. Later, as the crust cooled, and meteor/comets delivered a little more gold, that gold stayed towards the surface. This all means gold is hundreds of more times as common in other parts of the solar system.

The currency, which has thousands of years of history, has been a stable currency the world over for a reason.

The Western Roman Empire switched to the gold standard right before the deflation of the Dark Ages.... So not thousands of years.

Due to it's high value per ounce, it is often paired with silver for day to day transactions.

And that is a whole other nightmare. A dual metal standard requires the government to try to make two metal prices ratio the same over time. Because those metal are the basis of entire economies, it means massive losses. The British were sometimes spending half their entire government income on trying to keep gold and silver ratios constant.