The figures I provided are not projections, speculation, or reinterpretations. They are literal excerpts from the U.S. Treasury’s “Historical Debt Outstanding” dataset and the Committee for a Responsible Federal Budget’s published analyses. You are free to disagree with my conclusions, but the numerical statements themselves are not in dispute.

The Treasury numbers you quoted back at me are exactly the ones I used.

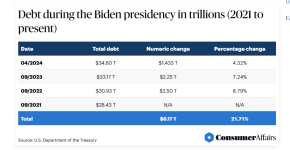

Debt at end of FY 2021: ~28.45T

FY 2022: ~30.93T

FY 2023: ~33.17T

FY 2024: ~35.46T

Source: U.S. Treasury, FiscalData.

These are not “speculations” or “excuses”; they are the official totals. They show a ~7T rise during Biden’s term because that is what the Treasury dataset records.

The deficit figure (~1.8T for FY 2024) comes directly from CRFB.

CRFB is a non-partisan budget watchdog. Their conclusion that FY 2024 was one of the largest non-pandemic deficits is their wording, not mine. Again, this is a reported number, not an interpretation.

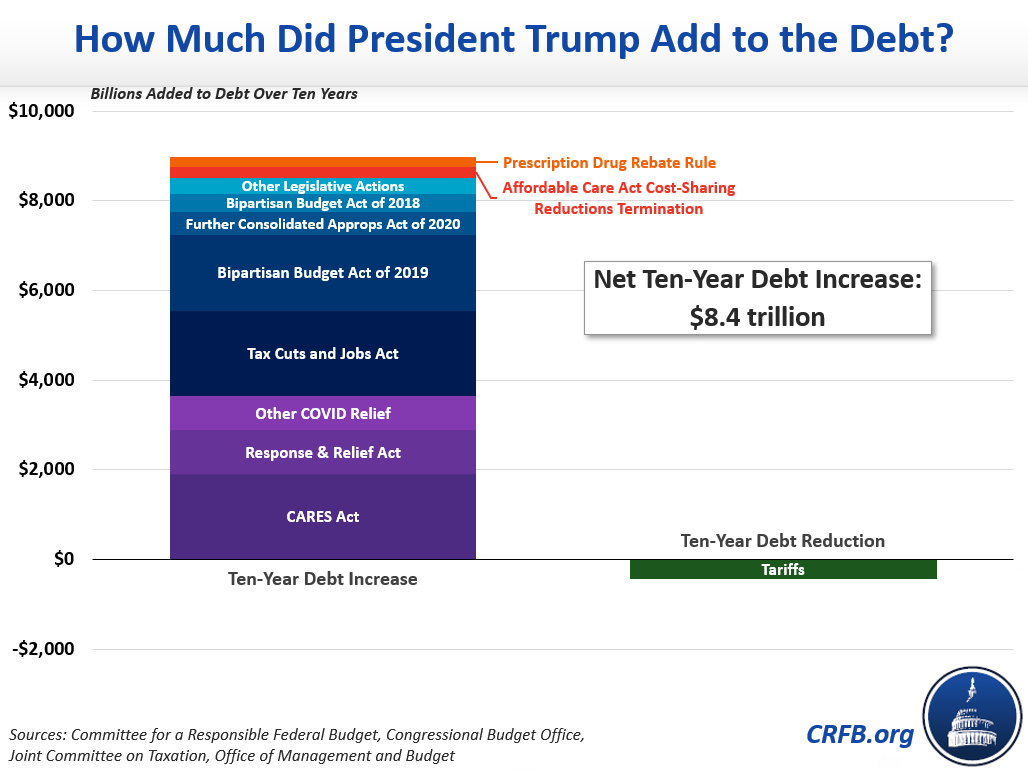

The 8.4T (Trump) and 4.3T (Biden) ten-year borrowing numbers are taken directly from CRFB’s comparison report.

CRFB provides both “total” and “excluding COVID relief” numbers for each president. I quoted both to avoid selective framing. These are not inventions; they are the published figures in the report I linked.

Saying that debt rose sharply during Biden’s term is simply a description of the dataset.

I did not say he “caused” all of it. I said the debt rose from ~28.45T to ~35.46T while he was in office. That is a factual, time-stamped observation. Whether one attributes that rise to inherited conditions, legislative choices, economic cycles, or global events is a separate debate.

Your claim that I am ignoring COVID relief under Trump is incorrect.

In the very same outline you are criticizing, I cited CRFB’s distinction between:

– Trump total borrowing: ~8.4T

– Trump excluding COVID: ~4.8T

– Biden total borrowing: ~4.3T

– Biden excluding COVID: ~2.2T

If anything, I went out of my way to avoid the simplistic narrative you are accusing me of using.

The dispute here is not about the numbers. The numbers come directly from the Treasury and CRFB. The disagreement is about interpretation, but you cannot dismiss the figures themselves as “dishonest” when they are reproduced exactly from the sources provided. If you want to argue causes or responsibility, that is a different conversation — but the empirical record is not in question.

My position is straightforward and fully supported by the public record. I cited the debt levels recorded by the U.S. Treasury at the start and end of Biden’s term and at the start of Trump’s current term and late 2025. I also cited CRFB’s published figures on new ten-year borrowing approved under each president. These are not projections or interpretations; they are time-stamped facts from the sources provided. My statements describe what the debt was during each presidency, not who personally “caused” each increase, which is a separate analytical question involving Congress, inherited obligations, interest, and economic conditions.

The pushback you are making assumes I was assigning full causal responsibility to one president or absolving another. I made no such claim. You are reading a narrative into the numbers that I did not assert. The data show only the debt levels over time and the borrowing approved in specific legislative periods. Any further interpretation is coming from your assumptions, not from what I actually wrote.

Wow, that's a lot of (dis) information.

Let's start with what is true and semi-true.

The national debt on Jan. 19, 2017, the day before Donald Trump was inaugurated president, was $19,944,429,217,107.

On Jan. 19, 2021, the day before Joe Biden was inaugurated, the debt was: $27,752,835,868,445 — about $7.8 trillion higher.

You pumped it up to $8.4 - just a bit of padding.

$4 trillion was on relief for the Wuhan Designer Virus®. Leaving about $3.8 trillion. Of that, nearly $2.4 trillion was accrued debt across 10 years due to the middle class tax breaks passed by congress in 2018. Accrued debt not due to spending, but the reduction in expected revenue over 10 years due to the reduction in the tax burden carried by working families.

Likewise some pretty serious game are played with the Biden debt. Whereas debt that accrues across 10 years due to the middle class tax cuts is directly attributed to Trump, such accrual is not employed with Biden and the "Green Raw Deal" or so-called "deficit reduction act." The Green Raw Deal in fact caused the Non-Covid Biden debt to be $6.1 Trillion.

U.S. debt by president: dollar and percentage 2025

Of all the U.S. presidents, Barack Obama increased the national debt the most. Donald Trump ranks second due in part to coronavirus relief spending.

Again, the delta between what the DNC press corps reports and the actual number is due to accruing future revenue reduction due to tax cuts to Trump, but NOT accruing the debt from the Green Raw Deal to Biden.

So why the disparity in reporting? Because the OMB is a highly partisan group that is not obligated to follow GAAP. What is particularly infuriating is the realization that the Green Raw Deal is basically an embezzlement scheme to transfer trillions in taxpayer money to the well connected billionaires of the democrat party.