One major factor is the perception that Delaware’s courts, particularly the Chancery Court, have become less predictable and more interventionist. High-profile cases, like the rejection of a massive executive compensation package, have raised concerns among corporate leaders about judicial overreach. Companies worry that decisions once reliably left to boards and shareholders are now subject to scrutiny, reducing the certainty that drew them to Delaware in the first place.

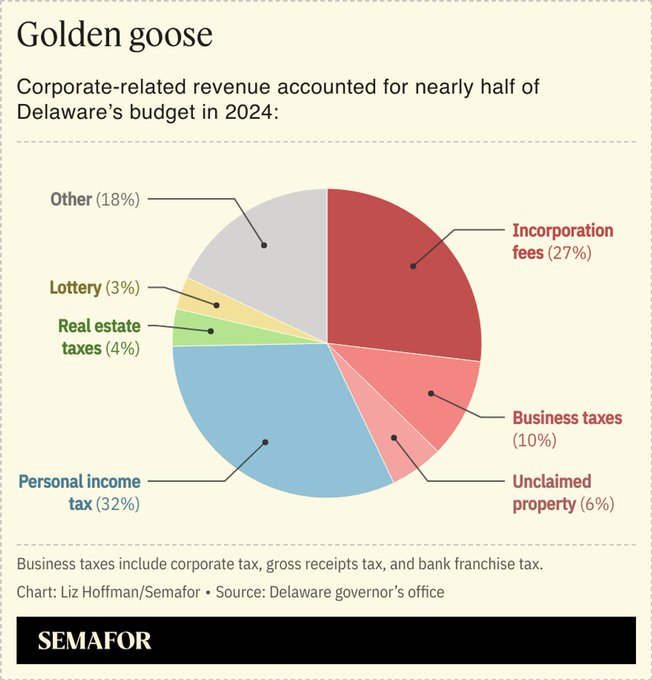

Additionally, rising costs play a role. Delaware imposes franchise taxes that scale with company size, which can become burdensome for large corporations. While these fees were once offset by the state’s legal advantages, some firms now see them as less justified given the evolving judicial climate.

Competing states like Nevada and Texas are capitalizing on this discontent. Nevada offers simpler governance rules, stronger liability protections for directors and officers, and a less litigious environment. Texas, meanwhile, is pushing to attract businesses with new business courts and a reputation for being more hands-off, appealing to companies seeking flexibility and lower risks of shareholder lawsuits. Both states also tout lower costs compared to Delaware’s franchise tax structure.

The trend isn’t a full exodus yet—Delaware still hosts over 60% of Fortune 500 companies—but the movement reflects a broader reevaluation. Businesses are weighing whether Delaware’s once-unmatched stability still outweighs the benefits offered elsewhere, especially as other states actively court them with tailored incentives.

@Grok