I'm Watermark

Diabetic

"

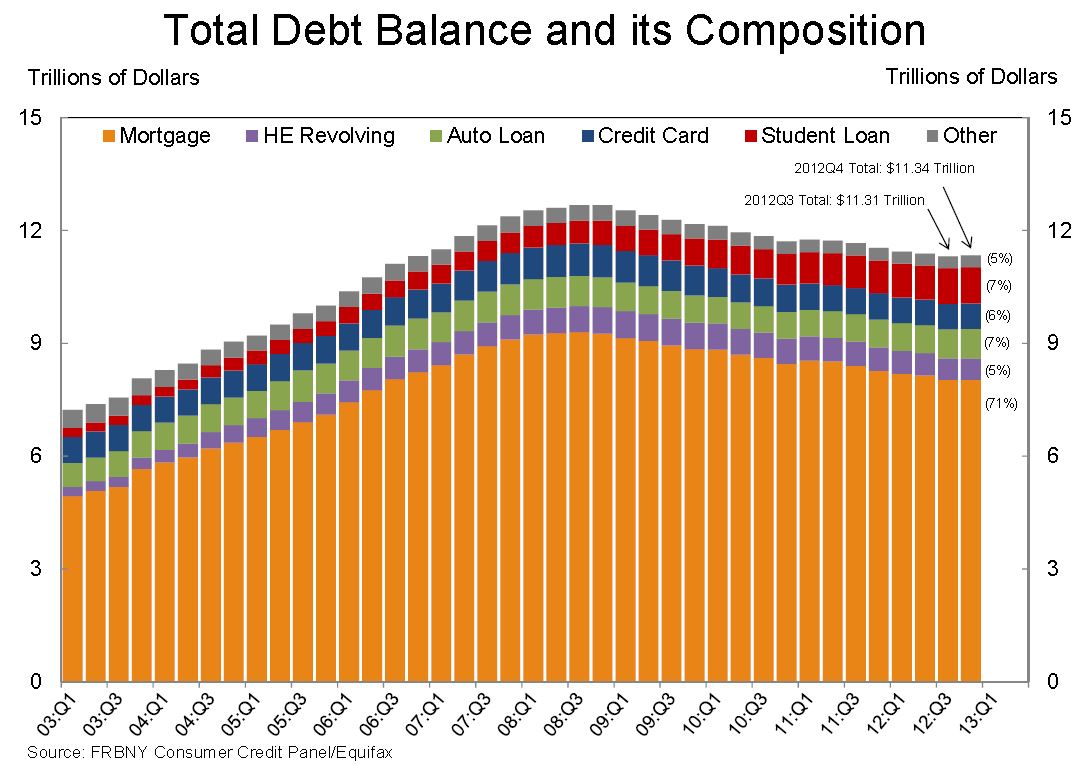

The absolute value of student debt is high enough to cause concern. But it's worth noting that student debt has grown so rapidly relative to other kinds of debt in large part because consumers have tried to lower debt during the recession. Student debt growth may be more resilient during a recession than other kinds of consumer debt because it represents an investment rather than consumption, and because many people might see additional education as an alternative to trying to find a job in a down market. Whatever the reason for the uninterrupted growth in student debt, it seems that it's been crowding out other kinds of borrowing over the course of the downturn, as this somewhat hard to read graph shows:

It will be interesting to see whether these trends hold up when (and if) the economy fully recovers. It's possible that auto, credit, and other kinds of debt will once again outpace student debt once Americans start feeling comfortable about spending money and taking on debt again. But it's likely that higher education financing will become one of the more pressing policy questions in the years ahead.

Update: It might be helpful to include a bigger-picture view of private debt and the household deleveraging process that's taken place over the past few years. This is from Calculated Risk:

"

http://www.realclearpolicy.com/blog/2013/02/28/the_rise_of_student_loan_debt_438.html

The absolute value of student debt is high enough to cause concern. But it's worth noting that student debt has grown so rapidly relative to other kinds of debt in large part because consumers have tried to lower debt during the recession. Student debt growth may be more resilient during a recession than other kinds of consumer debt because it represents an investment rather than consumption, and because many people might see additional education as an alternative to trying to find a job in a down market. Whatever the reason for the uninterrupted growth in student debt, it seems that it's been crowding out other kinds of borrowing over the course of the downturn, as this somewhat hard to read graph shows:

It will be interesting to see whether these trends hold up when (and if) the economy fully recovers. It's possible that auto, credit, and other kinds of debt will once again outpace student debt once Americans start feeling comfortable about spending money and taking on debt again. But it's likely that higher education financing will become one of the more pressing policy questions in the years ahead.

Update: It might be helpful to include a bigger-picture view of private debt and the household deleveraging process that's taken place over the past few years. This is from Calculated Risk:

"

http://www.realclearpolicy.com/blog/2013/02/28/the_rise_of_student_loan_debt_438.html