cawacko

Well-known member

This is John Mauldin's weekly column, this one on home ownership and the cost of real estate. It's not about partisan politics but it's relevant because regardless of one's politics, having a place to live is extremely important and for most people who own their home it's their most valuable asset. In interviews with people one reason they are so frustrated with the economy is the cost of housing and the belief home ownership is only getting further out of reach. (the column addresses why we don't build small starter homes like we use to and how much the cost of regulations and red tape add to a home, making them far less affordable for people.)

It also addresses the claims of corporate (or oligarchs) owning real estate and the effects (or lack thereof) on pricing.

For those so inclined to read it it might be easier at the link. It didn't come out well pasting it and it wouldn't let me paste the entire column.

www.mauldineconomics.com

www.mauldineconomics.com

Ever notice how “home” is so important to our holiday traditions? It’s hard to imagine Christmas without images of a fireplace, a tree, some food, and rooms with festive decorations. Families gather in such rooms to form lifelong bonds and memories.

My neighborhood here in Puerto Rico really goes all out on Christmas decorations. There are more than a few snowmen and other winter decorations that make me smile.

Yet for many, having that kind of home is an elusive dream because our economy isn’t providing enough of them. Whether you want to buy or rent, finding an affordable, comfortable home can be extremely difficult, if not impossible.

The basic reason is clear: Supply just can’t keep up with demand. But the factors behind this mismatch are proving more stubborn than they should. We should all be asking why this is such a problem, for two reasons.

First, a society in which everyone can find an affordable home is more stable, peaceful, and prosperous. And second, if the housing shortage isn’t already affecting you (or your kids and grandkids)… it will soon.

Over Thanksgiving, I learned that one of my kids had bought a nice home in Tulsa, high mortgage rates and all. It got me to thinking about the state of housing in the US.

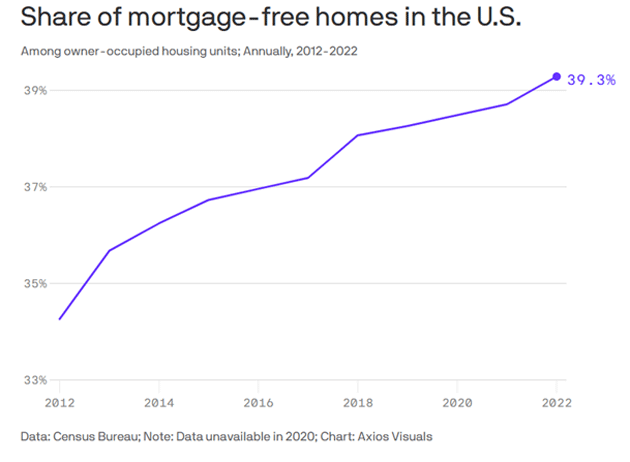

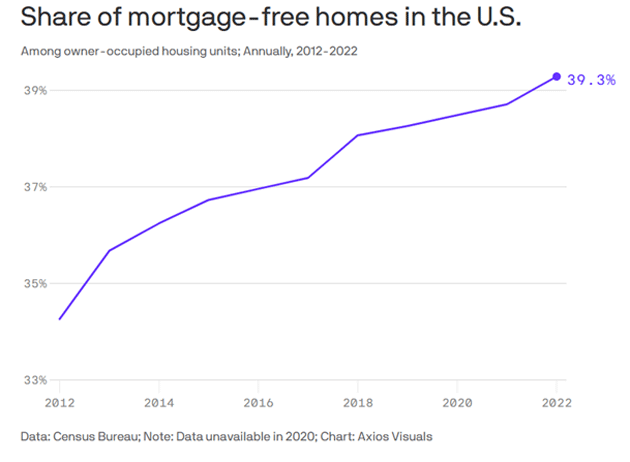

Source: DQYDJAlmost 40% of homeowners own their home free and clear of any mortgage.

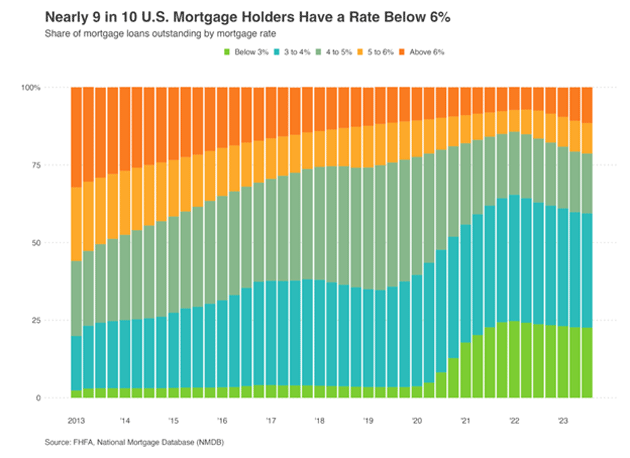

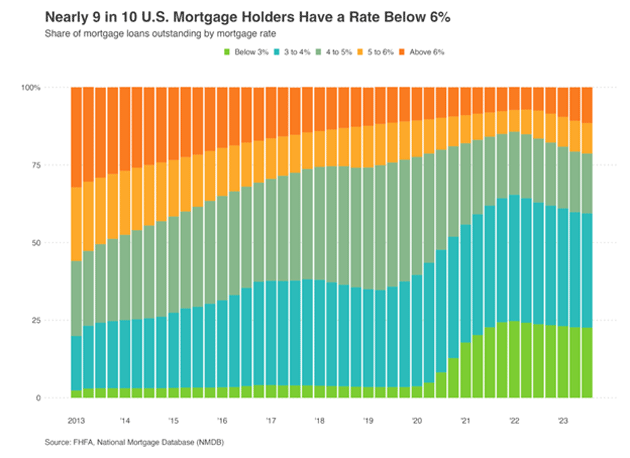

Source: AxiosBut of those with mortgages, most have rates significantly below the 6% that used to be normal.

Source: FHFA, National Mortgage Database (NMDB)What that means is almost 60% of America has a mortgage below 4%. My kids felt they could handle the 6% mortgage. I smiled and remembered when I was about their age and I had a 12% mortgage. Things worked out. Admittedly, not the way I planned, but that’s another story.

What about those people that don’t own their homes or can’t afford one? That’s the problem that we will focus on.

It is true that investors own many homes. By definition, every rental home is owned by someone who doesn’t live there. That’s what makes it a “rental.” This isn’t new and there’s nothing wrong with it. Rental property investors provide a valuable service, at no small risk to themselves.

Plenty of people don’t want to own the building in which they live, for all kinds of reasons. I didn’t own a home from the mid-’90s up until 2014. Renting was cheaper and more convenient.

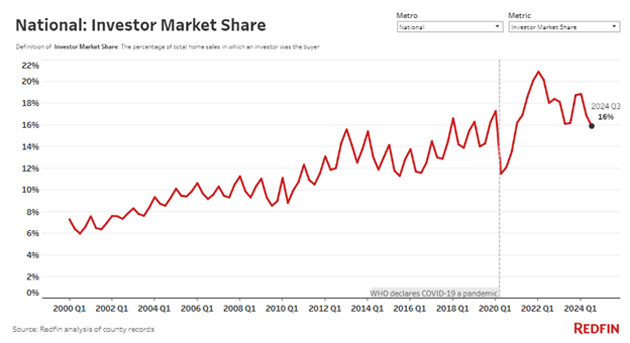

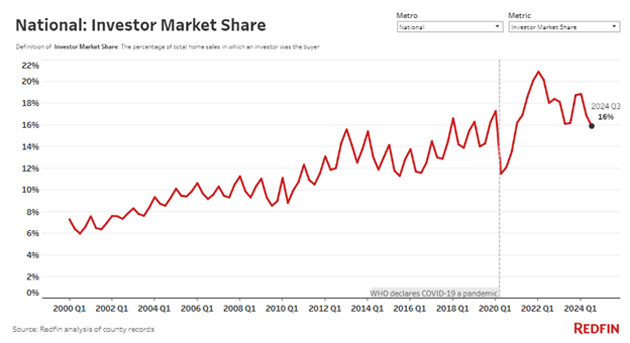

It’s also true that investors have been buying more homes. This goes back quite a few years according to Redfin’s data. Investors purchased 15.9% of all US homes sold in this year’s third quarter. That number, which has been rising for a long time, shot way up in 2021–2022 (when rates were lower!) but now seems to be returning to the previous trend.

Source: RedfinIt is less clear who the investors are. They range from individuals who own a handful of properties to large funds with thousands of homes, plus some relatively smaller mid-size investors in between.

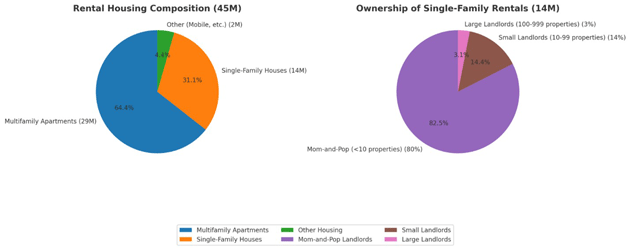

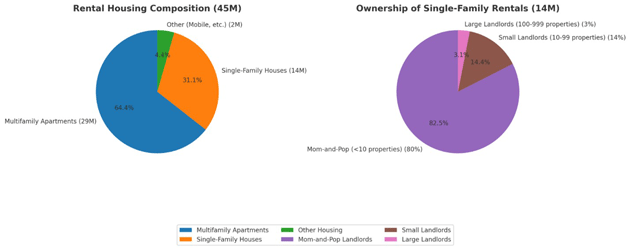

As of 2020, the US had 19.3 million rental properties which had 49.5 million rental units. Most of the properties were single units, i.e., houses. The rest were apartments, condos, etc. Individual investors owned 70.2% of the rental properties. These are, presumably, the traditional local landlords who own one or a few homes, perhaps as a sideline business. Think Airbnb, etc., which has become quite large. Clearly not oligarchs.

Single-family rentals are owned mostly by small investors, not giant corporations. The data suggests only about 3% are owned by landlords with more than 100 properties.

Source: Sunrise Capital GroupIn fairness, this is hard to decipher because there are numerous categories of non-individual property owners: partnerships, LLCs, trusts, nonprofits, REITs, and so on. Some of these are probably individuals who, for estate planning or liability purposes, choose not to own their rental properties directly. There are over 2 million Airbnb listings in the US out of 7 million worldwide. This Rutgers report estimates that large institutional investors owned only 574,000 single-family homes as of June 2022. If so, it supports the other estimates of large investors owning only 3%–5% of rental houses.

Generally, though, the ownership picture is exactly what you would expect. Individual investors tend to own smaller properties like single-family homes, duplexes, and small apartment buildings. The various corporate structures tend to be larger developments. So, if we have an oligarch problem, that’s where it is. Except that it’s not.

These institutions are almost entirely just combinations of small investors. Who owns REITs? Pension plans, endowment funds, and regular people just saving for retirement. Wealthy investors are in there, too, but they aren’t necessarily in controlling positions.

This idea that oligarchs are monopolizing the housing market just doesn’t fit the data. Much of the commercial real estate today is owned by investment funds which are in turn owned by individuals or funds like teacher, police, and fire department pensions, insurance companies, etc. Yes, those managing those funds make a lot of money using what is called OPM—Other People’s Money. It’s America and called capitalism.

That said, there may be something else going on. It’s about technology, not ownership.

Setting rent used to be guesswork. Leaving a property vacant while you try to identify what the market will bear can be costly. Many owners would set a number that covered their costs plus a profit margin, then adjust occasionally. Modern software is giving landlords better information, often letting them charge higher rates.

A company called RealPage does this so well it is now being sued by the US Justice Department and eight states for alleged price fixing. The suit claims the company’s pricing algorithm “enables landlords to share confidential, competitively sensitive information and align their rents.”

To me, this doesn’t sound like cartel behavior. The landlords who use RealPage software aren’t meeting in a dark room to set artificially high prices. It’s more like the systems airlines and hotels use to make sure every seat/room is sold at the best possible price. As a frequent traveler, I can certify this is highly aggravating at times. But the good part is I can usually get where I want to go. Profits are what encourage more supply. Further, the same kind of technology also gives renters better information, helping them find lower rates. It’s a two-way street.

Nevertheless, this kind of optimization may boost rental rates in some places to a level they would not have reached otherwise. That’s frustrating for renters now but should also create more supply and eventually bring rates down... unless something else gets in the way—like local regulations and building codes.

It also addresses the claims of corporate (or oligarchs) owning real estate and the effects (or lack thereof) on pricing.

For those so inclined to read it it might be easier at the link. It didn't come out well pasting it and it wouldn't let me paste the entire column.

Homes for Christmas

John Mauldin explains why housing supply is such a tough problem.

Homes for Christmas

Ever notice how “home” is so important to our holiday traditions? It’s hard to imagine Christmas without images of a fireplace, a tree, some food, and rooms with festive decorations. Families gather in such rooms to form lifelong bonds and memories.

My neighborhood here in Puerto Rico really goes all out on Christmas decorations. There are more than a few snowmen and other winter decorations that make me smile.

Yet for many, having that kind of home is an elusive dream because our economy isn’t providing enough of them. Whether you want to buy or rent, finding an affordable, comfortable home can be extremely difficult, if not impossible.

The basic reason is clear: Supply just can’t keep up with demand. But the factors behind this mismatch are proving more stubborn than they should. We should all be asking why this is such a problem, for two reasons.

First, a society in which everyone can find an affordable home is more stable, peaceful, and prosperous. And second, if the housing shortage isn’t already affecting you (or your kids and grandkids)… it will soon.

Over Thanksgiving, I learned that one of my kids had bought a nice home in Tulsa, high mortgage rates and all. It got me to thinking about the state of housing in the US.

Let’s Talk Homeownership

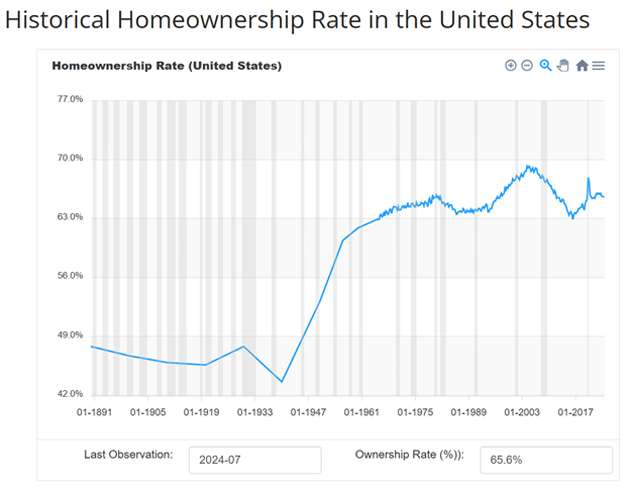

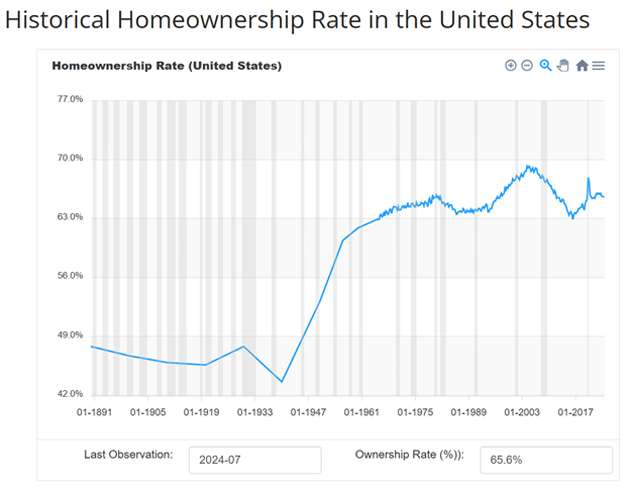

65.6% of Americans own their homes, roughly the percentage that it has been for the last 50 years, down slightly the last few years.

Source: DQYDJ

Source: Axios

Source: FHFA, National Mortgage Database (NMDB)

What about those people that don’t own their homes or can’t afford one? That’s the problem that we will focus on.

Market Share

I have a regular reader, someone quite famous whom I know personally, who agrees housing is a big problem. But whenever I write on this topic, he castigates me for not blaming the “oligarchs” whom he says are purchasing large numbers of homes, thus driving up prices and raising rents.It is true that investors own many homes. By definition, every rental home is owned by someone who doesn’t live there. That’s what makes it a “rental.” This isn’t new and there’s nothing wrong with it. Rental property investors provide a valuable service, at no small risk to themselves.

Plenty of people don’t want to own the building in which they live, for all kinds of reasons. I didn’t own a home from the mid-’90s up until 2014. Renting was cheaper and more convenient.

It’s also true that investors have been buying more homes. This goes back quite a few years according to Redfin’s data. Investors purchased 15.9% of all US homes sold in this year’s third quarter. That number, which has been rising for a long time, shot way up in 2021–2022 (when rates were lower!) but now seems to be returning to the previous trend.

Source: Redfin

The most comprehensive study I could find was this 2022 Congressional Research Service study, which cites 2021 research by the US Census Bureau and Department of Housing and Urban Development. They, in turn, looked at raw data from a 2020 survey. This is all a few years old but things haven’t changed all that much looking at recent less rigorous analysis. What does it say?As of 2020, the US had 19.3 million rental properties which had 49.5 million rental units. Most of the properties were single units, i.e., houses. The rest were apartments, condos, etc. Individual investors owned 70.2% of the rental properties. These are, presumably, the traditional local landlords who own one or a few homes, perhaps as a sideline business. Think Airbnb, etc., which has become quite large. Clearly not oligarchs.

Single-family rentals are owned mostly by small investors, not giant corporations. The data suggests only about 3% are owned by landlords with more than 100 properties.

Source: Sunrise Capital Group

Generally, though, the ownership picture is exactly what you would expect. Individual investors tend to own smaller properties like single-family homes, duplexes, and small apartment buildings. The various corporate structures tend to be larger developments. So, if we have an oligarch problem, that’s where it is. Except that it’s not.

These institutions are almost entirely just combinations of small investors. Who owns REITs? Pension plans, endowment funds, and regular people just saving for retirement. Wealthy investors are in there, too, but they aren’t necessarily in controlling positions.

This idea that oligarchs are monopolizing the housing market just doesn’t fit the data. Much of the commercial real estate today is owned by investment funds which are in turn owned by individuals or funds like teacher, police, and fire department pensions, insurance companies, etc. Yes, those managing those funds make a lot of money using what is called OPM—Other People’s Money. It’s America and called capitalism.

That said, there may be something else going on. It’s about technology, not ownership.

Setting rent used to be guesswork. Leaving a property vacant while you try to identify what the market will bear can be costly. Many owners would set a number that covered their costs plus a profit margin, then adjust occasionally. Modern software is giving landlords better information, often letting them charge higher rates.

A company called RealPage does this so well it is now being sued by the US Justice Department and eight states for alleged price fixing. The suit claims the company’s pricing algorithm “enables landlords to share confidential, competitively sensitive information and align their rents.”

To me, this doesn’t sound like cartel behavior. The landlords who use RealPage software aren’t meeting in a dark room to set artificially high prices. It’s more like the systems airlines and hotels use to make sure every seat/room is sold at the best possible price. As a frequent traveler, I can certify this is highly aggravating at times. But the good part is I can usually get where I want to go. Profits are what encourage more supply. Further, the same kind of technology also gives renters better information, helping them find lower rates. It’s a two-way street.

Nevertheless, this kind of optimization may boost rental rates in some places to a level they would not have reached otherwise. That’s frustrating for renters now but should also create more supply and eventually bring rates down... unless something else gets in the way—like local regulations and building codes.