You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The price of gold has reached an all-time high. It hit $2,942.65 on February 11, 2025.

- Thread starter Diogenes

- Start date

Diogenes

Nemo me impune lacessit

"I pity the fool" that doesn't own gold.

As do I. I suspect that none of the JPP justice warriors do, due to the lack of threads blaming Trump for the price escalation.

Trump is playing golf. President Musk is in charge.As do I. I suspect that none of the JPP justice warriors do, due to the lack of threads blaming Trump for the price escalation.

Diogenes

Nemo me impune lacessit

Trump is playing golf.

Is that so? Where?

President Musk is in charge.

Who?

Diogenes

Nemo me impune lacessit

Investors invest in gold when they think dark times are ahead. Trump and Musk are harbingers of hate taking power. Cruelty is not how our government operates. Trump brings darkness.

Cry about it some more, will you?

Gold goes high when people are scared, especially of inflation, but also just scared. The more scared they are the higher it generally goes.The price of gold has reached an all-time high. It hit $2,942.65 on February 11, 2025.

Discuss.

Then it collapses based on a billion factors that no one understands. Remember the gold collapse of 2012, well, Cyprus banking caused that. I don't care how smart you are, you were not following Cyprus banking's connection to gold prices."I pity the fool" that doesn't own gold.

Diogenes

Nemo me impune lacessit

Gold goes high when people are scared, especially of inflation, but also just scared. The more scared they are the higher it generally goes.

Then, without a pause, Salty Walty added the following:

Then it collapses based on a billion factors that no one understands. Remember the gold collapse of 2012, well, Cyprus banking caused that. I don't care how smart you are, you were not following Cyprus banking's connection to gold prices.

Yes, that is what I said. It goes high on the panic about the bad times, and then drops on the detail no one saw coming.Then, without a pause, Salty Walty added the following:

By definition gold does not grow. It is a zero sum game.

Diogenes

Nemo me impune lacessit

Yes, that is what I said. It goes high on the panic about the bad times, and then drops on the detail no one saw coming. By definition gold does not grow. It is a zero sum game.

Is that so?

Gold speculation itself isn’t inherently a zero-sum game, but it often plays out that way in practice, depending on the context—like whether you’re talking about physical gold or financial instruments like futures and options.

In a zero-sum game, one player’s gain is exactly equal to another’s loss, with no net value created. If you’re speculating on physical gold—buying bars or coins hoping the price rises—you’re not directly taking money from someone else. The market price shifts based on supply, demand, and sentiment, and if you sell at a profit, the buyer isn’t necessarily “losing” in that moment; they’re betting on future gains themselves. Total wealth can grow if gold’s value rises due to external factors like inflation or geopolitical instability. So, in this sense, it’s not strictly zero-sum.

But flip to derivatives—gold futures, options, or CFDs—and it gets closer to zero-sum territory. These are contracts where you’re betting on price movements without owning the metal. For every winner in a futures trade, there’s a loser on the other side, as the contract’s value is redistributed between parties. The pot doesn’t grow or shrink beyond what’s wagered; it just shifts hands. Data from the Commodity Futures Trading Commission (CFTC) shows speculative positions in gold futures often balance out long and short bets, reinforcing this dynamic—non-commercial traders (speculators) held net long positions of 204,000 contracts in early 2025, offset by shorts elsewhere.

Even so, the broader gold market isn’t fully zero-sum. Mining adds supply, industrial use consumes it, and central banks hoard it, all injecting or extracting value outside speculative trades. Speculation can amplify price swings—say, when hedge funds pile in—but it’s not a closed loop like poker.

So, is gold speculation zero-sum? In physical markets, no, because value can grow or shrink system-wide. In derivatives, mostly yes, since gains and losses net out between traders. Depends on how you’re playing the game.

@Grok

Explain gold futures

Silver speculation dynamics

If you invest in Microsoft, you hope they produce something with that investment. If you "invest" in gold, you hope someone else will have to buy it for more money.In a zero-sum game, one player’s gain is exactly equal to another’s loss, with no net value created.

Diogenes

Nemo me impune lacessit

If you invest in Microsoft, you hope they produce something with that investment. If you "invest" in gold, you hope someone else will have to buy it for more money.

Is that so?

People invest in gold for several reasons, driven by its unique properties and historical role in economies. Here’s a breakdown of the main motivations:

- Hedge Against Inflation: Gold is often seen as a store of value that retains purchasing power when fiat currencies lose value due to inflation. When prices rise, paper money buys less, but gold tends to hold or increase its worth.

- Safe Haven Asset: During times of economic uncertainty, political instability, or market volatility (e.g., stock market crashes), investors turn to gold because it’s considered a stable, tangible asset less prone to wild swings than stocks or bonds.

- Diversification: Gold has a low or negative correlation with other financial assets like equities or real estate. Adding it to a portfolio can reduce overall risk, balancing losses if other investments falter.

- Currency Devaluation Protection: When governments print more money or currencies weaken (e.g., during hyperinflation), gold often rises in value since it’s not tied to any single nation’s economy or policy.

- Historical Value and Trust: Gold has been a form of wealth for thousands of years, from ancient civilizations to modern times. This long track record gives it a psychological edge—people trust it as a fallback when systems fail.

- Limited Supply: Unlike paper money, gold can’t be printed or easily produced. Its scarcity (mined at a slow, predictable rate) supports its value over time, especially as demand grows.

- Speculation and Price Appreciation: Some invest in gold hoping its price will rise due to demand (e.g., from industries like jewelry or tech) or global economic trends, aiming for profit rather than just preservation.

- Liquidity: Gold is universally recognized and can be sold or traded almost anywhere in the world, making it a practical asset for emergencies or quick cash needs.

@Grok

You omitted an explanation of why people are buying it now that Trump is in power. Trump's bringing chaos to the American and world economies is the reason. Investors see an ugly future with Trump the incompetent in power.Is that so?

People invest in gold for several reasons, driven by its unique properties and historical role in economies. Here’s a breakdown of the main motivations:

People’s reasons vary based on their goals—some want security, others profit—but gold’s appeal lies in its blend of reliability, rarity, and resilience.

- Hedge Against Inflation: Gold is often seen as a store of value that retains purchasing power when fiat currencies lose value due to inflation. When prices rise, paper money buys less, but gold tends to hold or increase its worth.

- Safe Haven Asset: During times of economic uncertainty, political instability, or market volatility (e.g., stock market crashes), investors turn to gold because it’s considered a stable, tangible asset less prone to wild swings than stocks or bonds.

- Diversification: Gold has a low or negative correlation with other financial assets like equities or real estate. Adding it to a portfolio can reduce overall risk, balancing losses if other investments falter.

- Currency Devaluation Protection: When governments print more money or currencies weaken (e.g., during hyperinflation), gold often rises in value since it’s not tied to any single nation’s economy or policy.

- Historical Value and Trust: Gold has been a form of wealth for thousands of years, from ancient civilizations to modern times. This long track record gives it a psychological edge—people trust it as a fallback when systems fail.

- Limited Supply: Unlike paper money, gold can’t be printed or easily produced. Its scarcity (mined at a slow, predictable rate) supports its value over time, especially as demand grows.

- Speculation and Price Appreciation: Some invest in gold hoping its price will rise due to demand (e.g., from industries like jewelry or tech) or global economic trends, aiming for profit rather than just preservation.

- Liquidity: Gold is universally recognized and can be sold or traded almost anywhere in the world, making it a practical asset for emergencies or quick cash needs.

@Grok

Diogenes

Nemo me impune lacessit

You omitted an explanation of why people are buying it now that Trump is in power. Trump's bringing chaos to the American and world economies is the reason. Investors see an ugly future with Trump the incompetent in power.

Is that a fact?

This is an interesting subject on many levels:

1) The price going up so fast

2) Central Banks are buying hard as if they expect gold to be super important as the new global financial system that is being built

3) We might finally find out if the Americans have been lying about how much gold is at Ft Knox

4) There are increasingly concerns that globally a lot of the precious metals that have been paperized and traded dont actually exist, which if true when it becomes known will be as catastrophic as will the processing that much of the global debt will never be paid.

5) There has long been speculation that some governments such as Russia and China are holding a lot more gold than they claim, that they have long been accumulating under the table.

1) The price going up so fast

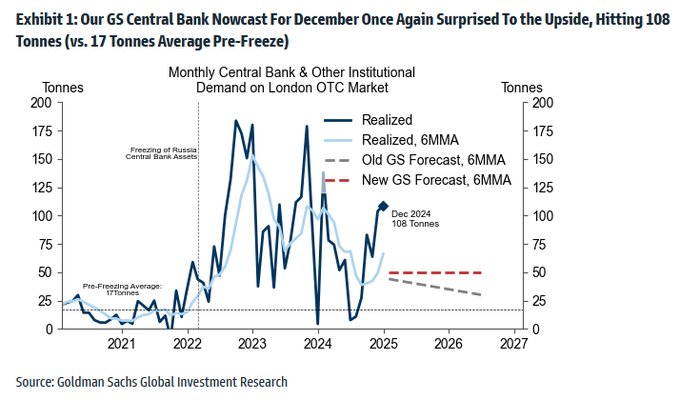

2) Central Banks are buying hard as if they expect gold to be super important as the new global financial system that is being built

3) We might finally find out if the Americans have been lying about how much gold is at Ft Knox

4) There are increasingly concerns that globally a lot of the precious metals that have been paperized and traded dont actually exist, which if true when it becomes known will be as catastrophic as will the processing that much of the global debt will never be paid.

5) There has long been speculation that some governments such as Russia and China are holding a lot more gold than they claim, that they have long been accumulating under the table.