Teflon Don

I'm back baby

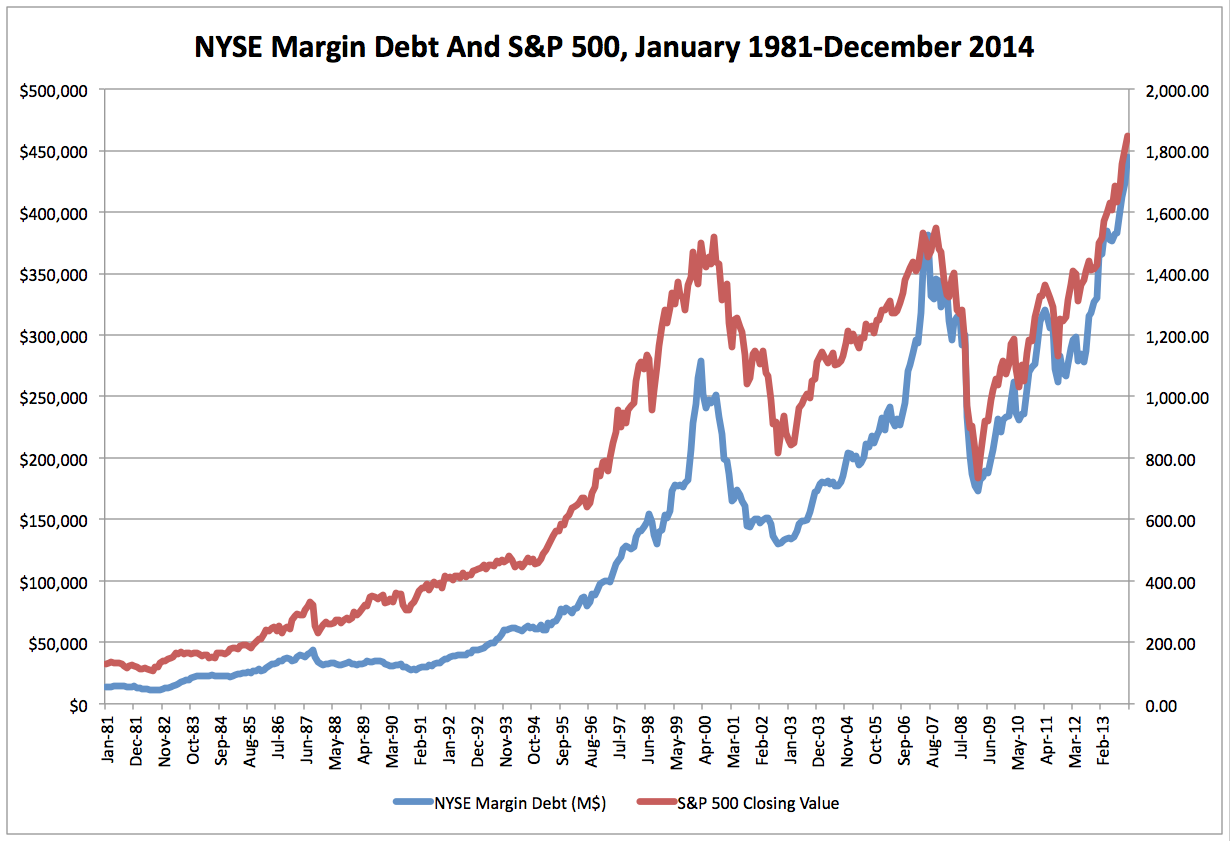

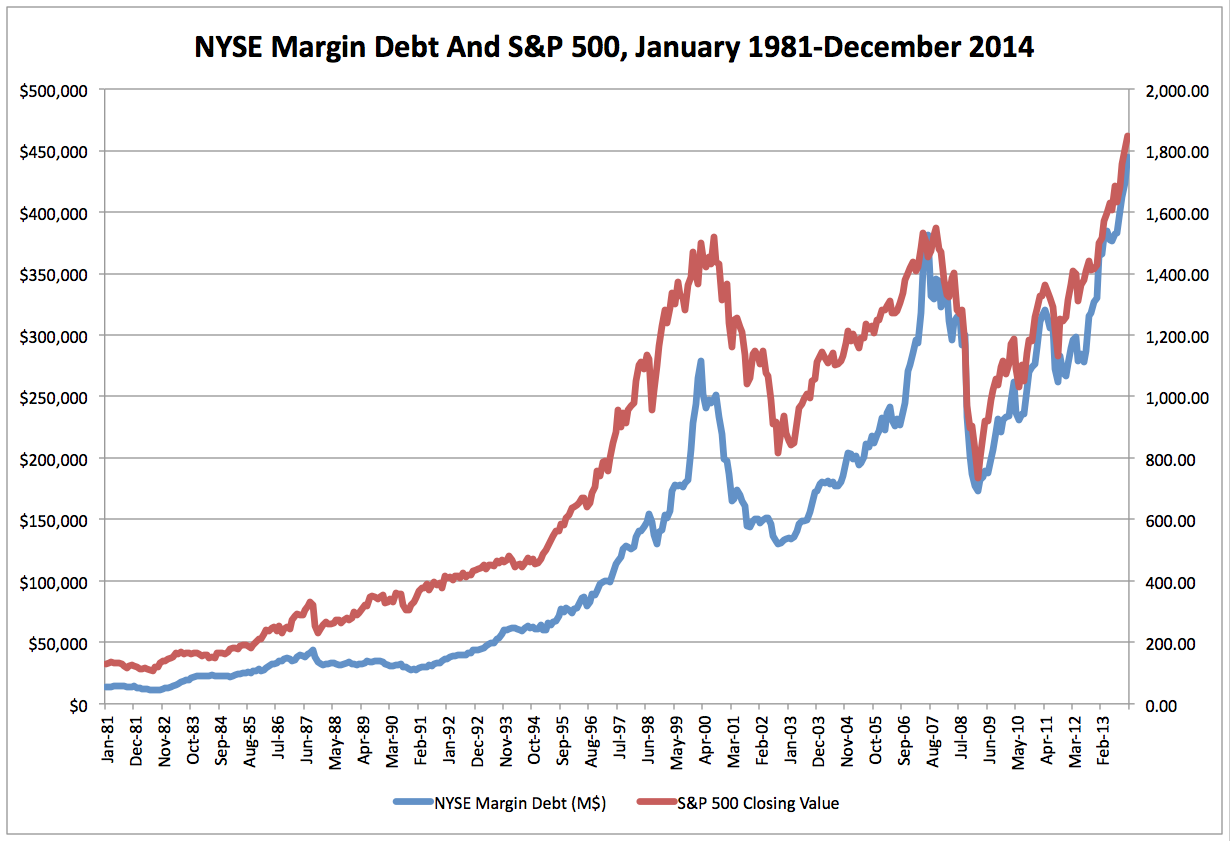

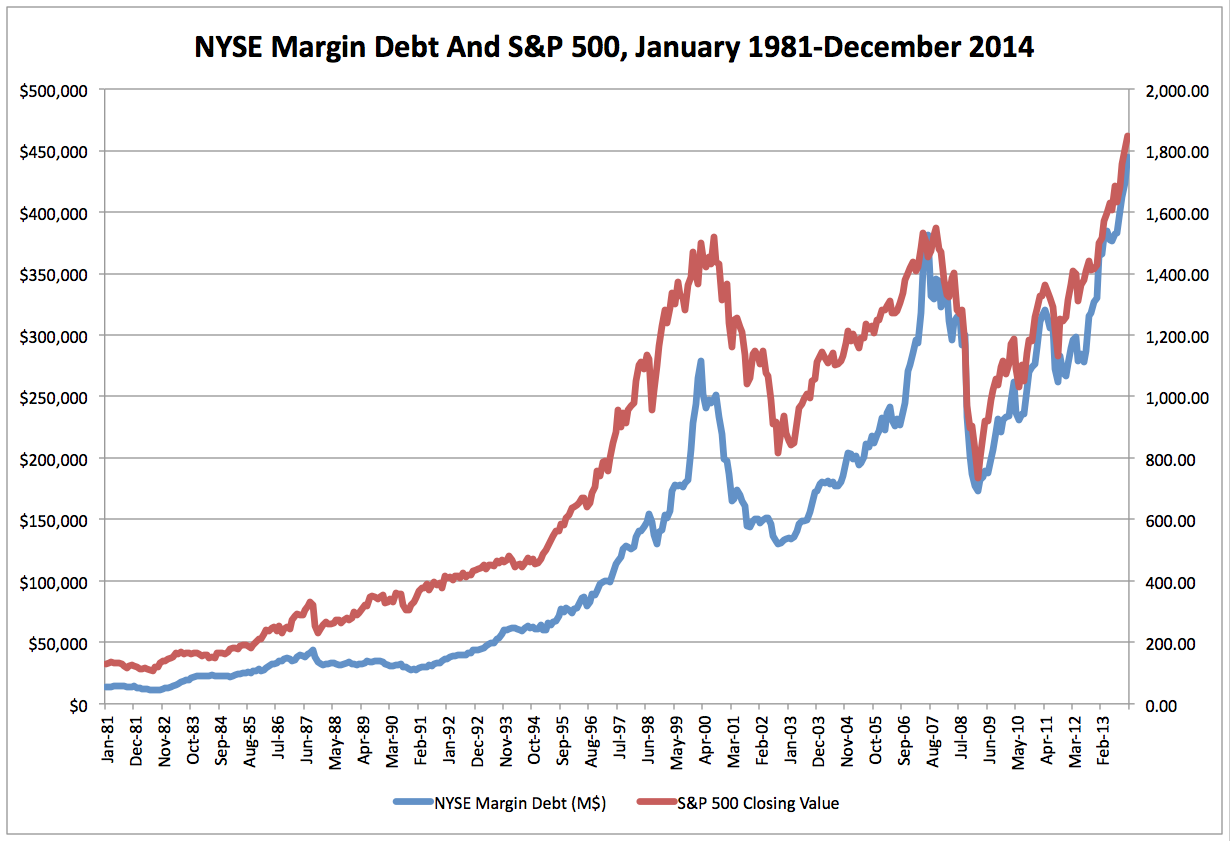

Why is this important? Well, if you look at the chart, when margin debt climbed to these extremes in 2000 and 2007 there was a big time fall. Will history repeat itself?

Oh and one other thing. It looks like a "Head and Shoulders" is forming. There is a defined left shoulder and a head, the right shoulder looks in process but hasn't formed yet.

Head and shoulders formations are bad news.

We are up pretty good since your short call.

I don't know anyone who's used margin.

IMO it's hedge funds or financial industry money.