PostmodernProphet

fully immersed in faith..

ALSO RELY ON WRITTEN DECLARATIONS

except they don't.....the bank officer testified they calculated Trump's net worth at $2.5B, slightly over half what Trump had estimated......

ALSO RELY ON WRITTEN DECLARATIONS

Damocles is not a person anyone should listen to on any topic as his track record is almost always to be wrong.

does not mean they do not ALSO rely on written declarations.

The readers of this thread must realize that Damocles and the others here saying you can lie and represent anything you want to get a loan or insurance and it is not a crime because the Banks do some checks are not just wrong but very stupid.

Buyer beware is done to help protect the lender but it DOES NOT absolve the borrow of his lies as they want you to believe.

Banks and Insurance companies ALSO rely on legal attestations. So you will sign a form, for instance saying you have not given any other legal incumbrancers on your assets, as it is possible you gave a private contract of security to another person over the landor assets that is not registered and thus the Bank would not find it in diligence. The bank does not want some 3rd party person showing up with a signed contract from you, from years prior, that they hold security over the land. the bank relies on that attestation from you that the land is 'unencumbered', even though they might check for 'registered' encumbrances.

So do not be fooled by derps , like Damocles, who are arguing 'lying is fine to do as the banks do their own checks'. The latter does not mean you do not commit a crime, if you lie.

No it does not.

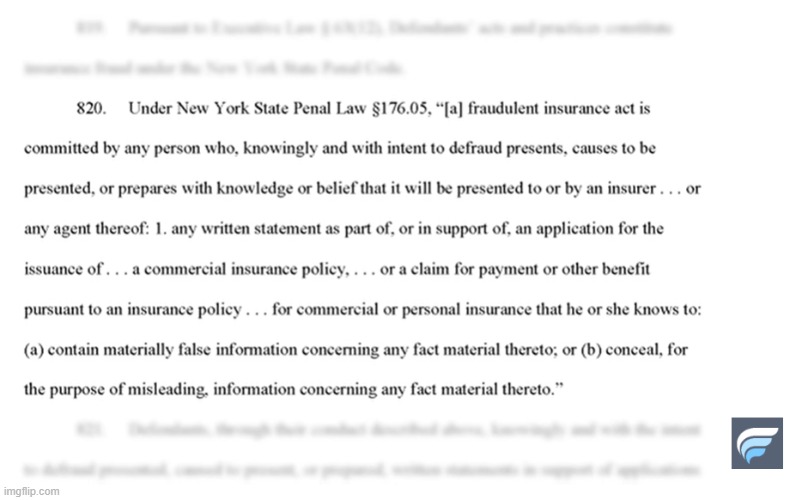

I have cited above numerous legal statutes that criminalize lying on those doc's.

So, New York state has convicted Trump of multiple felonies in a criminal trial? Really? When did that happen?

When did Trump commit insurance fraud?

thanks.....if that is the basis of the "crime" it obviouly has been improperly applied......this applies to fraudulent insurance claims......what claim did Trump file?......

except they don't.....the bank officer testified they calculated Trump's net worth at $2.5B, slightly over half what Trump had estimated......

Trump’s fraudulent financial statements were key to getting loans, former bank official says

Donald Trump obtained hundreds of millions of dollars in loans using financial statements that a court has since deemed fraudulent, a retired bank official testified Wednesday at the former president’s New York civil fraud trial.

Trump’s statements of financial condition were key to his approval for a $125 million loan in 2011 for his Doral, Florida, golf resort and a $107 million loan in 2012 for his Chicago hotel and condo skyscraper, former Deutsche Bank risk management officer Nicholas Haigh testified.

They also helped Trump secure bigger loans and lower interest rates, said Haigh, who headed the risk group for the bank’s private wealth management unit from 2008 to 2018.

...Deutsche Bank’s rules required Trump to act as a guarantor for the Doral and Chicago loans in addition to putting up the Miami-area resort and Wabash Ave skyscraper as collateral, meaning he would’ve been obligated to repay the loans if his properties faltered.

Deutsche Bank’s private wealth management unit, which handled the loans, wouldn’t have approved them without a “strong financial guarantee” from Trump, Haigh said.

Haigh said he reviewed Trump’s financial statements before approving the loans and, at the time, had no reason to doubt their validity.

The documents portrayed Trump as a wealthy businessman, heavily invested in golf courses and other real estate with strong cash flow and little debt, Haigh said. Deutsche Bank representatives also met with Trump Organization executives to go over the information, he said.

“I assumed that the representations of the assets and liabilities were broadly accurate,” Haigh said of Trump’s financial statements.

Trump’s 2011 financial statement listed his net worth as $4.3 billion. Haigh said he used that figure to shape a loan condition requiring that Trump, as guarantor, maintain a minimum net worth of $2.5 billion, excluding any value derived from his celebrity.

“As the ultimate decider, I needed to be comfortable with the terms of the loan, including the covenants that protected the bank,” Haigh said. The $2.5 billion benchmark, he said, was set “to ensure the bank was protected in adverse market conditions.”...

you cited a statute that talks of illegal insurance claims......Trump has not filed an insurance claim.....wake the fuck up......

What they do is they have qualified real estate assessors actually assess the property value based on government filings (square footage, rooms, so forth) not based on the owner's best guess of what it is worth, etc. They don't issue loans based on what you guess your house is worth, if they do they are not doing their due diligence and would never pass stress tests. They don't employ lawyers for this part of the loan process they employ real estate assessors. It's idiotic to assume that banks would give you a loan because you said your house was worth eleventy-billion when it is only worth eleventy-million.

Look upthread as i already screenshot directly from the court transcript for Terry prior, the judge using one of Trumps fraudulent Insurance filings ALSO as part of his findings.

You do know, as claimed real estate lawyer, that Banks will typically make you provide proof of Insurance for Properties they have loans against right? So if Trump fraudulently claimed the property was worth 10X, for his bank loan, he would also have to tell the Insurance company fraudulently it was worth 10x to get the policy to match.

Tell me you know that is how it works?

Were his banks paid in full during the 6 bankruptcies his companies went through?

Paying in full on time is not relevant to if there was fraud or not.

Paying in full on time is not relevant to if there was fraud or not.

Do you honestly believe that even if the loans were paid back in full (I haven't seen evidence of that) that would mean there was no fraud in the inducement of those loans? Do you believe everything trump says without thinking about it or are you dumb?

As always you must go off top to show your hate for Trump

Yes it is if there is no loss there is no fraud

think about the precedence set by this case.

do we want ignorant judges to be able to look at a private contract between two private parties and point at a number and say "i don't like that" with no parties to the contract even having brought suit or action of any kind?

You have insisted that Trump paid his banks in full. Thats a lie!