FUCK THE POLICE

911 EVERY DAY

Krugman delivers yet another resounding pWn to conservative economics (or, as later generations will put it, mythology).

http://krugman.blogs.nytimes.com/2009/06/06/wheres-the-money-coming-from/

Where’s the money coming from?

The huge borrowing by major governments, the U.S. government in particular, has confused many people — and not just Niall Ferguson. What I hear again and again is either the assertion that all this borrowing must drive up interest rates, or worries that the Chinese won’t be willing to lend us the money.

We know as a matter of principle that these concerns are misplaced: if there were a shortage of savings, the economy wouldn’t be depressed. Indeed, one way to think about our current problem is that the world as a whole wants to save more than it’s willing to invest.

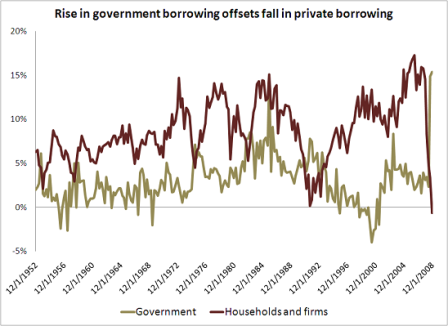

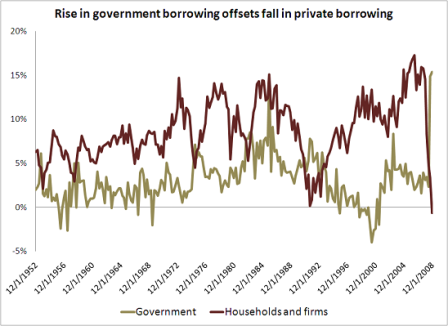

But it’s always nice to have some real-world data illustrating a principle. From Brad Setser, private and public borrowing in America, as a percentage of GDP:

We’re actually borrowing less from foreigners than we were before.

http://krugman.blogs.nytimes.com/2009/06/06/wheres-the-money-coming-from/

Where’s the money coming from?

The huge borrowing by major governments, the U.S. government in particular, has confused many people — and not just Niall Ferguson. What I hear again and again is either the assertion that all this borrowing must drive up interest rates, or worries that the Chinese won’t be willing to lend us the money.

We know as a matter of principle that these concerns are misplaced: if there were a shortage of savings, the economy wouldn’t be depressed. Indeed, one way to think about our current problem is that the world as a whole wants to save more than it’s willing to invest.

But it’s always nice to have some real-world data illustrating a principle. From Brad Setser, private and public borrowing in America, as a percentage of GDP:

We’re actually borrowing less from foreigners than we were before.