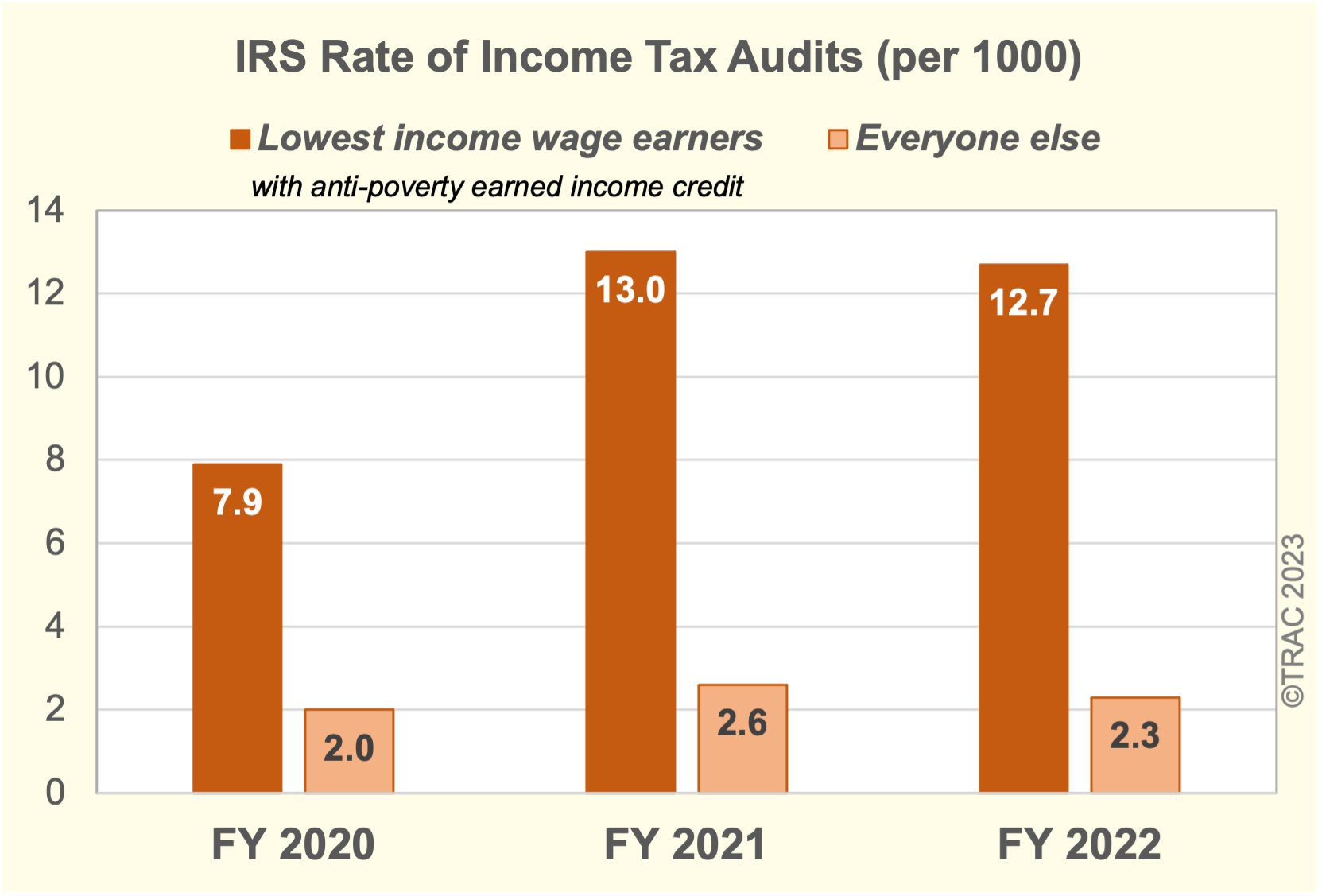

Why defund the IRS? So that the wealthy can get away with making the working man pay for the military and roads we all depend on?

Seriously look a this.... Who benefits by defunding the IRS?

The working man gets his taxes taken out of his paycheck before he gets control of them... The wealthy are required to report their income and pay it after the fact.

You fucks fell for another one.

Seriously look a this.... Who benefits by defunding the IRS?

The working man gets his taxes taken out of his paycheck before he gets control of them... The wealthy are required to report their income and pay it after the fact.

You fucks fell for another one.