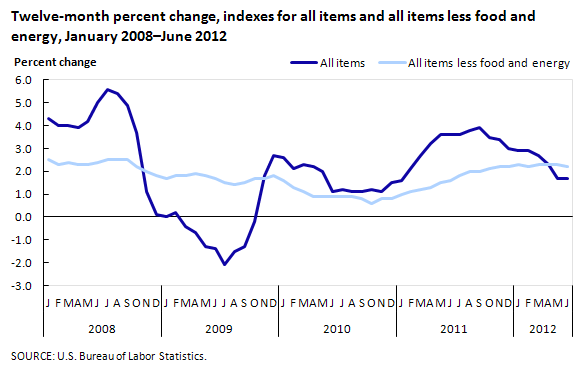

Here's a chart of both all items and all items less food and energy. Inflation is not high:

Here's a chart of inflation for food at home over the past five years. Again, not high:

And here is apparel. It did spike somewhat in 2011 after being flat for a while, but it is on the downslope:

Finally, here is energy:

No, I know full well what I'm talking about. Inflation is not high and is not a problem. The real problem is unemployment. That is what needs to be dealt. If inflation does become a problem, the FED has plenty of tools in its arsenal to deal with it.

Also, too, I know you think you've made a point when you keep saying that I parrot things or whatever, but the stuff that I'm saying is mainstream economic thought. You, on the other hand, are regurgitating right-wing faux intellectual bullshit that serve to benefit rich people. Enough projection, SF.

Obama? I'm voting Johnson.

Giving money to states is actually a great answer. If government employment grew under Obama at the same rate it grew under Bush, we'd have 7% unemployment right now. The cut backs at the state and local government level have been huge drags on the recovery. In any event, that's not going to happen anyway so who cares.

Also, I know that you think this "future generation" thing is a great point, but it really isn't. Cutting government spending as you want to do just shrinks the economy and makes debt worse. The best thing to do for debt in the near term is to spend lots of cheap money to get the economy cooking again.