You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

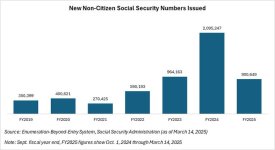

Biden's 1.3 million Illegals got Social Security Numbers on Taxpayer Benefits

- Thread starter Libhater

- Start date

No source as usual.And These illegal gotten security numbers are going illegally voting in bulk.

These 1.3 million illegals are currently on Medicaid.

View attachment 48491

Libhater

Verified User

Oh, the graph wasn't good enough for you?No source as usual.

A link would be good.Oh, the graph wasn't good enough for you?

Libhater

Verified User

How about a video? It's only 12 minutes long, but it gives you all the inside data on and how these illegalsA link would be good.

were able to obtain social security numbers.

The source is at the bottom of the graph. DUH!No source as usual.

I saw it. Not too hard to link it.The source is at the bottom of the graph. DUH!

T. A. Gardner

Serial Thread Killer

Okay, so somewhere between 5 and 10% of the illegals Biden let into the country got a SSN... And?

Seems to me the sheer number let in by Biden is a far bigger problem.

Seems to me the sheer number let in by Biden is a far bigger problem.

T. A. Gardner

Serial Thread Killer

Maybe. Most work and pay nothing in taxes or social security.Illegals work and pay taxes, but they cannot collect from SS or other government agencies.

The source is at the bottom of the graph. DUH!

Math is racist n stuff.

In any case ....

Specifically, a noncitizen who files an application for benefits based on an SSN assigned on or after January 1, 2004, is required to have work authorization at the time an SSN is assigned, or at some later time, to gain insured status under the Social Security program.<a href="https://www.congress.gov/crs_external_products/RL/HTML/RL32004.web.html#fn14" name="ifn14" title="See Social Security Act, § 214(c). The 2004 law provides exceptions to the work authorization requirement for certain noncitizens (i.e., noncitizens who are admitted to the United States under a B visa (for business purposes) or D visa (for service as a crew member) at the time quarters of coverage are earned).">14</a> If the individual had work authorization at some point, all of his or her covered earnings count toward insured status (and for benefit computation purposes). If, however, the individual never had authorization to work in the United States, none of his or her covered earnings count toward insured status (and therefore benefits would not payable based on his or her work record).<a href="https://www.congress.gov/crs_external_products/RL/HTML/RL32004.web.html#fn15" name="ifn15" title="Before enactment of P.L. 108-203 , all Social Security-covered earnings count ed toward insured status and for benefit computation purposes, regardless of a person's work authorization status.">15</a>

A noncitizen who files an application for benefits based on an SSN assigned before January 1, 2004, is not subject to the work authorization requirement under P.L. 108-203. All of the individual's Social Security-covered earnings are counted toward insured status (and for benefit computation purposes), regardless of his or her work authorization status.

The treatment of earnings based on unauthorized work for Social Security purposes is often an issue when Congress considers legislation to legalize all or part of the unauthorized population residing in the United States. For example, the most recent example of a comprehensive immigration reform bill (S. 744 as passed by the Senate in the 113th Congress) contained provisions that would have prohibited most persons legalized under the bill from counting earnings obtained before the person legalized toward insured status under the program or for benefit computation purposes. In addition, in the 114th Congress, H.R. 1996 would prohibit those who received work authorization under the Deferred Action for Childhood Arrivals (DACA) program from receiving SSNs and receiving Social Security benefits.<a href="https://www.congress.gov/crs_external_products/RL/HTML/RL32004.web.html#fn16" name="ifn16" title="In 2012, the Department of Homeland Security (DHS) issued a memorandum announcing that certain unauthorized individuals brought to the United States as children and meet other criteria would be considered on a case-by-case basis for protection from removal for two years, subject to renewal, under an initiative known as Deferred Action for Childhood Arrivals, or DACA. See section entitled, "A Note About Deferred Action for Childhood Arrivals (DACA). " For more information on DACA, see CRS Rep...">16</a>

Those illegals who are allowed to work while waiting for their court appearances will probably be allowed to draw Social Security if it takes over 10 years to get their hearing, whether they become legal or not.

Last edited: