Worker pay is shrinking, the economy is still in the Bush depression, the trade deficit is growing, and the stock market is below 1999 levels, but CEO pay is still on steroids.

Yahoo's Terry Semel hauls in $230.6 million. That's more than $4 million a week.

Yahoo is on Lou Dobb's list of companies "sending American jobs overseas, or choosing to employ cheap overseas labor, instead of American workers."

It would take the pay of 7,075 average American workers to match the pay of Yahoo's CEO.

William McGuire, of UnitedHealth Group, the nation's leading health insurer, "earns" $124.8 million. His payout could cover the average health-insurance premiums of nearly 34,000 people.

"While executives are richly compensated, patients are tightening their belts," Dr. Isaac Wornom, chairman of the Richmond Academy of Medicine, wrote. "Premiums, deductibles and co-pays are up, while benefits continue to shrink. One million Virginians, one out of seven, have no health insurance at all, and this number is increasing. Half of the uninsured work full time for small businesses that simply can't afford the inflated rates."

CEOs win big even when their company loses.

When Merck, for example, had to pull its Vioxx pain medication off the market, and the stock was down 28 percent, CEO Ray Gilmartin got a supposedly performance-based bonus. His total compensation was $37.8 million, and he received a new grant of 250,000 stock options.

CEO pay of Fortune 500 public companies averages $10.2 million, counting salary, bonus, and other compensation, such as exercised stock options and vested stock grants.

Full-time-worker pay averages just $32,594.

That's 11 percent less than 1973's average worker pay, of $36,629, adjusted for inflation, although worker productivity rose 78 percent.

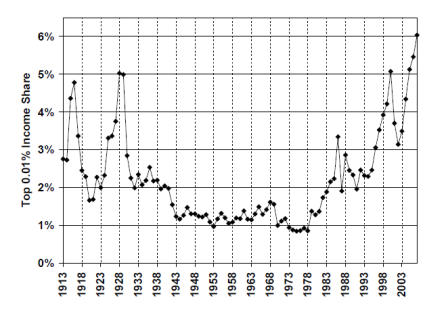

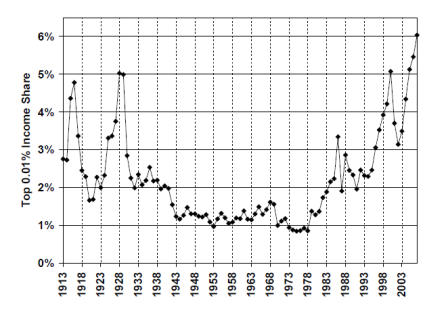

In 1973, CEOs made 45 times as much as workers, according to pay expert Graef Crystal.

In 1991, when Crystal said that the imperial CEO "is paid so much more than ordinary workers that he hasn't got the slightest clue as to how the rest of the country lives", CEOs made 140 times as much as workers. Last year, CEOs made more than 300 times as much.

Executive pay now takes more than double the bite out of company earnings that it did a decade ago, according to a recent study by Lucian Bebchuk, a Harvard professor of law, economics, and finance, and Yaniv Grinstein, of Cornell University's School of Management.

Looking at data for thousands of publicly traded companies, Bebchuk and Grinstein found that pay for the top-five company executives rose from 4.8 percent of aggregate net company income during 1993-95 to 10.3 percent of aggregate net income during 2001-03.

While workers are having a tougher time making ends meet, CEOs are getting perks worth more than worker paychecks.

CEO freeloaders expect such perks as lifetime use of company jets and chauffeured cars, company apartments, club memberships, sports tickets, financial planning, personal assistants, and more.

In CEO World, the more money you make, the less you should have to spend.

While worker pensions are increasingly unavailable or unreliable, CEO retirement gives new meaning to "the golden years."

CEO robber barons are increasingly stashing their loot in guaranteed pensions, deferred compensation, guaranteed consulting fees (no actual consulting necessary), and other post-retirement perks and compensation, to avoid shareholder scrutiny and sidestep the new rule for companies to treat stock options as expenses.

As Lucian Bebchuk and Jesse Fried, co-authors of Pay Without Performance, explained in a 2004 report, "camouflaged" compensation generates less outrage, is less tied to performance, and "allows executives to reap benefits at the expense of shareholders."

Making matters worse, CEOs earning more than their fair share were rewarded with huge tax cuts by the corrupt Bush regime.

Workers and their families are paying the biggest price as CEOs milk their companies and our country like cash cows.