signalmankenneth

Verified User

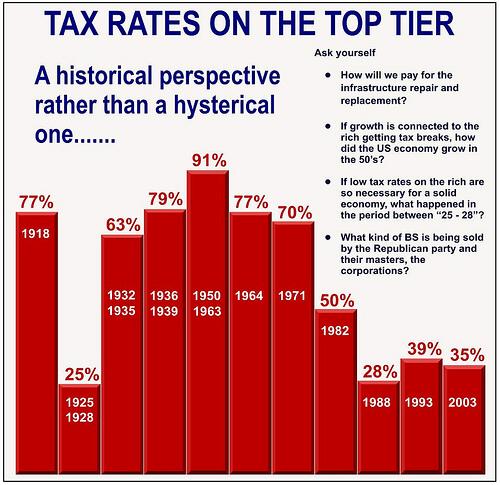

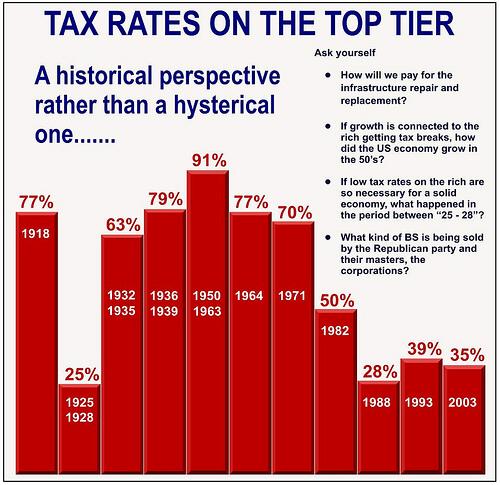

Saint Reagan taxed the super-rich at 50%

but

Obama is 'a Muslin' if he taxes them at 39%?

Reagan cut the top rate from 50% to 28% in the Tax Reform Act of 1986. As noted on the graph, the top rate was 28% by the time Reagan left office. Also I don't see any connection between taxes and Islam. Nobody has argued that, at least nobody in the mainstream of conservative thought.

Every time I see what the top rates were decades ago, I'm always pretty floored. They were really punitive...

Here's the thing, you fucktards... The people who have the wealth to start new business ventures and create new jobs, are the ones you are wanting to punish with a high income tax. They do not need to earn an "income" anymore, they are already wealthy. Once you have obtained wealth, your need to earn an income is gone, you don't need to do it anymore, because you have wealth. If their "income taxes" are high, they have no incentive to earn wealth, and they sit on their holdings, not earning an income and not paying income taxes. BUT.... If you do as Reagan did, and lower their income taxes to something reasonable, they suddenly become interested in making money again! Wealthy people generally do enjoy making money... they don't "need" to do it, they just LIKE doing it. They will open new businesses, hire new employees, create new jobs, products and services, and the economy starts to grow. PLUS, they are now paying an income tax again, because they are earning income.

You idiots really do need to reevaluate your war against the rich, you're not hurting them, you're hurting the rest of us. You see, you and I, we have no choice... if the government raises our taxes, we just have to pay it, we can't say... well I just won't work anymore! But a rich person can, they have enough money to live comfortably the rest of their lives, and usually enough for their kids and grandkids to do the same. It is to your advantage, to give these people an incentive to come off the cash, spend that money in an effort to make even more money... don't be jealous they are making profit, be jubilant! The more profit they make, the more tax revenues we collect. But you can't kill the golden goose, you have to give them some incentive to spend their money to earn more, or they simply won't do it... they have no reason to.

the problem i have with this type of argument is....it assumes that during the tax rates prior to reagan's 28%....that no one wanted to accumulate wealth

which is of course total meadowmuffins

Oh, there are giant conglomerate corporations owned by shareholders who always want to make money, and there's always some individuals who want to earn more wealth, even if they only get to keep 9% of what they earn. But the vast majority simply don't give a shit, they had rather vacation in Spain and forget about earning an income. What Reagan did, was to lower the top marginal rates, creating a real incentive for these people to invest their money into new business, with the promise of a generous return on investment. And it worked like a charm.

so your theory is....that the vast majority of people before reagan lowered tax rates, didn't give a shit.....

odd....given that the number of wealthy didn't rise in correlation to your claim

What do you mean? The number of wealthy didn't rise? What does that have to do with the wealthy earning income or not earning income? I didn't say Reagan created more wealthy people!

And, it's not "my claim" it's a fact. Reagan turned around the most dismal economy since the Great Depression, and presided over the longest period of peacetime prosperity ever. The keyword there is "prosperity!"

Mrs. Liberal Yurt, you need to give your husband back his keyboard now. I prefer the Conservative Mr. Yurt, thank you!