Thanks for the links.

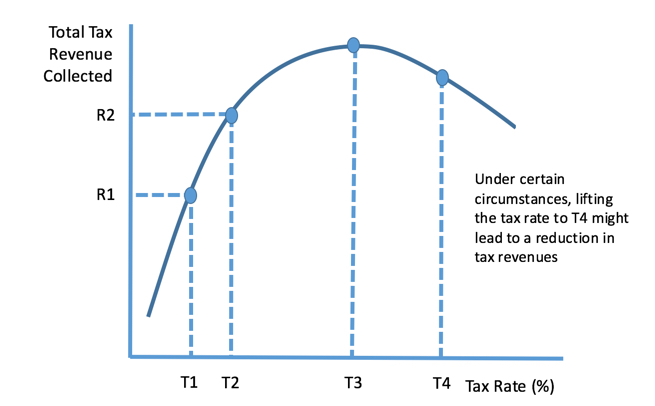

The first link is interesting but flawed since it assumes extremes. When assessing groups of people, be they farmers or industrial capitalists, there's an average that follows human behavior**. In short, on average, people will do what is best for themselves. They'll follow the rules of the game, sometimes violate those rules if they can get away with it (e.g. declaring the IRS maximum for charity donations that do not require receipts) As such, the Laffer Curve is a general model, but as both links point out, it's not the same for individuals and corporations.

The Guardian article lists a quote noting two problems:

Economists keep quoting the Laffer curve in trying to determine the rate of tax at which the actual tax take is maximised. The problem, of course, is twofold. When Arthur Laffer proposed his theory, industrial-scale tax avoidance was not being practised. His theory was that high tax rates discouraged people from working harder because the taxman benefited too much. So the first problem is the type of tax avoidance never imagined by Laffer. The second is that there is no such thing as an acceptable rate of tax to the amoral: any tax is too high a price to pay. To say, as George Osborne has, that rich people will modify their behaviour because he has dropped the top rate of marginal tax by 5% is laughable and will come back to haunt him. We need a royal commission into taxation and how it has come to pass that we are where we are with regard to tax avoidance.

Legislation will handle both. One is to limit how corporations avoid taxes. This may require international treaties. The UK had a much bigger problem with this. Also there are UK celebrities (and maybe one JPP member) who left the UK to dodge taxes.

The other isn't really a problem since the amoral bitch about everything. Ignore them. If they violate the law, prosecute them.

**I'm not an economist but after several fuckups in my twenties, I became a damn good saver and manager of my own funds. While not an economist, I do have some knowledge about human behavior. Individuals are difficult to predict without a period of close scrutiny, but large groups of people are much easier to predict because such behaviors always fall within range of human behaviors. For example, most people are socialized (meaning they know not to kill, rape or steal from each other) and most people want to be free to do as they please which often includes caring for their families. It doesn't matter what culture, what religion or anything else: If they are human, they will fall within a set range of behaviors.