You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SNAP/EBT discussion thread

- Thread starter Diogenes

- Start date

Unpopular opinion?

Once when the government forcibly robs your earnings and gives it to EBT recipients, and again when you go to the grocery store with what's left of your income to buy food. You're paying a third time so that morbidly obese people who got free Twinkies on your dime can be kept alive on government-funded healthcare for the rest of their non-productive lives.

What's the solution?

Ask yourself how poor or disabled people were able to avoid starvation before the government subsumed the functions of charities.

- The the SNAP program artificially inflates bad outcomes.

- The federal government is subsidizing groceries for 40 + million people (with money they took from someone else) which obviously drives up the cost of for everyone (supply and demand).

- Giveaways swell the money supply (inflation).

- SNAP allows people who would be thinner if they had to buy their own food become obese, then these same folks become dependent on government aid for their healthcare, which also adds massively to the national debt.

Once when the government forcibly robs your earnings and gives it to EBT recipients, and again when you go to the grocery store with what's left of your income to buy food. You're paying a third time so that morbidly obese people who got free Twinkies on your dime can be kept alive on government-funded healthcare for the rest of their non-productive lives.

What's the solution?

Ask yourself how poor or disabled people were able to avoid starvation before the government subsumed the functions of charities.

You figure the average illegal alien family con cinco hijos gets about $500 a month in food stamps.

So, if they are feeding the family on $40 a week, where is the rest going? Is this an admission that half of SNAP is used for fraud?

So, if they are feeding the family on $40 a week, where is the rest going? Is this an admission that half of SNAP is used for fraud?

You figure the average illegal alien family con cinco hijos gets about $500 a month in food stamps.

So, if they are feeding the family on $40 a week, where is the rest going? Is this an admission that half of SNAP is used for fraud?

Illegals are legally prohibited from receiving SNAP.

On the other hand, the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) is a federal program administered by the U.S. Department of Agriculture's Food and Nutrition Service (FNS). It provides supplemental foods, nutrition education, breastfeeding support, and health care referrals to low-income pregnant, postpartum, and breastfeeding women, as well as infants and children up to age 5 who are at nutritional risk. Unlike many federal benefits, WIC is not means-tested based on immigration status—eligibility focuses on categorical (e.g., pregnancy), residential, income, and nutritional risk criteria.

Immigration status does not affect WIC eligibility. This includes:

- U.S. citizens and nationals: Fully eligible if they meet other criteria.

- Lawful permanent residents (green card holders): Eligible immediately, with no waiting period.

- Refugees, asylees, parolees, and other qualified non-citizens: Eligible without restrictions.

- Undocumented immigrants: Eligible for themselves and their eligible children if they meet income and nutritional risk requirements. WIC does not require proof of citizenship or immigration documentation, and programs do not collect or share this information.

Last edited:

Yeah, but without SNAP - Frito-Lay and Coca-Cola will go bankrupt.

Yeah, but without SNAP - Frito-Lay and Coca-Cola will go bankrupt.

Perhaps.

Removing SNAP (Supplemental Nutrition Assistance Program) benefits entirely would likely cause negative financial outcomes for food producers, distributors, and retailers, particularly those serving low-income consumers.

Here's a breakdown supported by data and economic logic, which I'd suggest that you start using.

1. SNAP Represents a Massive Revenue Stream

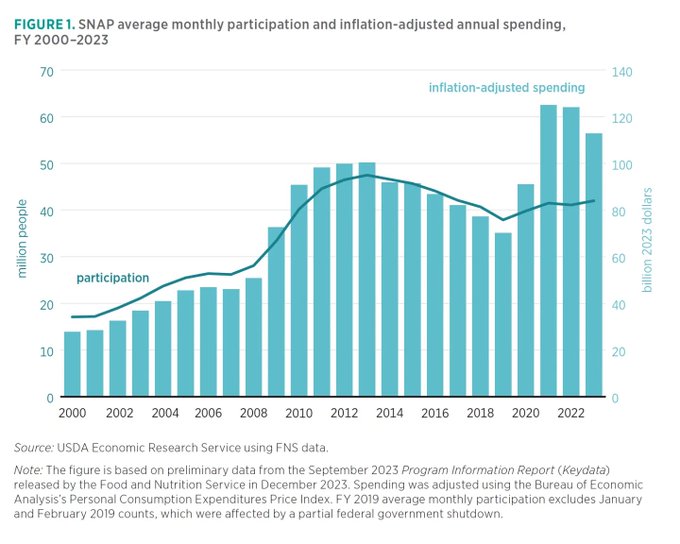

Annual SNAP spending is approximately $120–140 billion per year (USDA, FY 2023–2024). One hundred percent of SNAP benefits are spent on food, with roughly 80% redeemed at grocery stores and supermarkets. This serves as a guaranteed, high-velocity revenue channel for about 42 million low-income Americans.

2. Direct Impact by Sector

- Retailers (grocery stores, supercenters): They see over $100 billion in annual SNAP redemptions. Without SNAP, they would face severe revenue loss, especially in high-poverty areas. Chains like Walmart, Kroger, Aldi, and Dollar General rely on SNAP for 7–15% of U.S. food sales, with rural and inner-city stores potentially seeing 20–30% drops.

- Food Producers (CPG, meat, dairy, etc.): These would face a demand shock through reduced retail purchasing, leading to lower sales volume, reduced production, and either lower wholesale prices or layoffs. Packaged goods such as cereals, snacks, and canned items—often marketed to SNAP users—would be hit hardest.

- Distributors / Wholesalers: They would experience a volume collapse in low-margin, high-turnover items, resulting in reduced revenue from trucking, warehousing, and logistics.

The 2013 SNAP cuts of about $5 billion per year led to measurable declines in grocery sales, especially in rural areas, according to USDA studies. During COVID-era SNAP boosts (increases of 15% or more), grocers reported record food-at-home sales; the removal of these boosts in 2023 caused sharp sales drops, per Nielsen IQ data. State-level experiments, such as tightened eligibility in Missouri in 2016, showed immediate local retail sales dips.

4. Multiplier Effects

The USDA estimates that roughly 1 job is supported per $70,000 in SNAP spending, tying about 1.7 million jobs to SNAP demand. SNAP also has an economic multiplier of approximately 1.5–1.8 (USDA ERS), meaning $1 in benefits generates $1.50–$1.80 in broader economic activity, much of it in food retail.

5. Who Gets Hurt Most?

"Dollar stores" and discount grocers face high risk because they serve the highest percentage of SNAP users. Rural supermarkets are also at high risk, as they are often the only grocer in town and SNAP can account for 20–40% of sales. Meat, dairy, and bread producers face moderate-to-high risk due to heavy SNAP purchases in these staple categories. Premium and organic brands face low risk due to minimal SNAP penetration.

Bottom Line: Yes, food producers, distributors, and retailers would face significant negative financial outcomes without SNAP. The program is a core demand driver in the U.S. food economy. Removing it would trigger a supply-chain-wide contraction

Sources: USDA ERS, FMI, Nielsen IQ, CBO SNAP analyses (2020–2024).

Eliminating SNAP (Supplemental Nutrition Assistance Program) entirely would save the federal government approximately $100 billion annually, based on fiscal year (FY) 2024 spending levels.

This figure represents the program's total outlays, with about 93.5% ($93.8 billion) going directly to monthly benefits and the remainder covering administrative costs.

This figure represents the program's total outlays, with about 93.5% ($93.8 billion) going directly to monthly benefits and the remainder covering administrative costs.

If elimination occurs starting in FY 2025, annual savings would align with Congressional Budget Office (CBO) baselines, which project SNAP outlays at roughly $100–110 billion per year through 2034, depending on economic conditions and policy changes.

Over the 10-year window (FY 2025–2034), CBO estimates total SNAP spending at about $1.1 trillion (part of a $1.46 trillion combined farm and nutrition baseline).

Over the 10-year window (FY 2025–2034), CBO estimates total SNAP spending at about $1.1 trillion (part of a $1.46 trillion combined farm and nutrition baseline).

Illegals are legally prohibited from receiving SNAP.

That my friend is where anchor babies come in.

The SNAP benefits are in the name of the children.

That my friend is where anchor babies come in.

The SNAP benefits are in the name of the children.

Correct.

In a mixed-status household, (one with anchor babies) where some members are eligible (e.g., U.S.-citizen children) and others are not, the eligible members can still receive SNAP.

Correct.

In a mixed-status household, (one with anchor babies) where some members are eligible (e.g., U.S.-citizen children) and others are not, the eligible members can still receive SNAP.

So when the left claims that illegals don't get SNAP - they are flat out lying.