Um... Why do you think I would have a problem answering this? I don't like Trump, nor did I vote for him. I voted for Chase.Damocles a serious question if you will answer.

Now i suspect you will not answer as it would force you to recognize that Trump and Elon and maga lied to you and suckered you and many prefer to just ignore or live in denial of that truth but...

Now that it is clear that the main focus of the Budget bill the Magats in the House are pushing is deepening again, the tax cuts for the wealthiest American's and locking them in as permanent, while allowing the lesser tax relief provided to the middle class and poor to expire and also cutting Medicaid and food programs and all programs across the board that help the working poor, do you acknowledge that Trumps ENTIRE populist, 'i am for the working man' schtick was all just a lie?

Anyway the "big beautiful bill" as they call it locks in the tax rates that were set to expire in 2025, since there was a tax cut for the middle class in there it does not raise their taxes, nor do their tax cuts expire in the bill, they remain the same permanently rather than expire. So, since the middle class got a tax cut, this makes them permanent and your base premise just words without meaning. Anyway, the "big beautiful bill" also provides more child tax credits and other things that will reduce the tax burdens on the Middle Class.

I think that you'd be hard pressed to get a Union Man at the Ford Plant to agree with you that it is a "schtick", his protectionism seems to be the norm with him, there was a reason they stood by Trump in his campaign. Oddly, Sanders and other folks were for these idiotic protectionist tariffs before they became a Trump "idea". I have never been for that kind of thing, because Tariffs are a tax we pay at the retail level just as taxes on corporations are just more taxes we pay for at the retail level (in order to pay the tax they have to make the money and they aren't going to take less just because you call it tax), they are hidden sales tax. I don't think we should increase sales taxes unless we get rid of income taxes, using a constitutional amendment so it can't just go back after we institute a "national sales tax"....

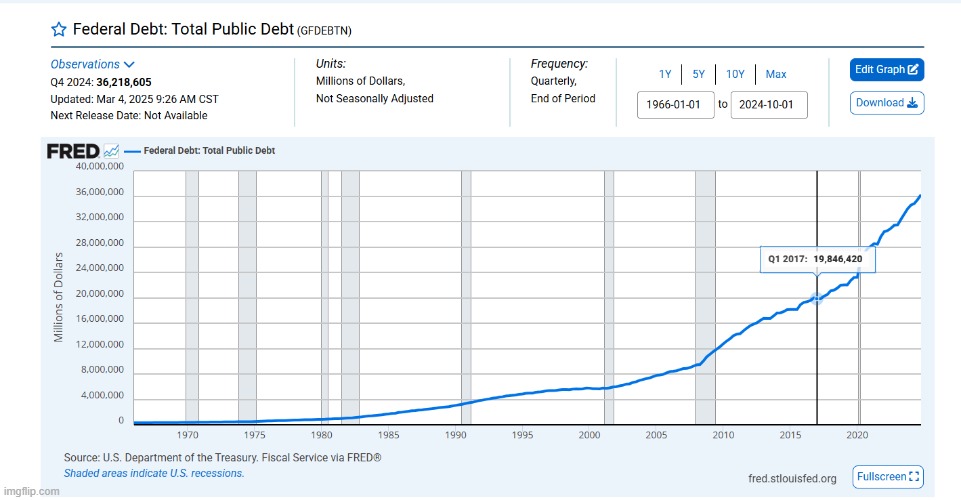

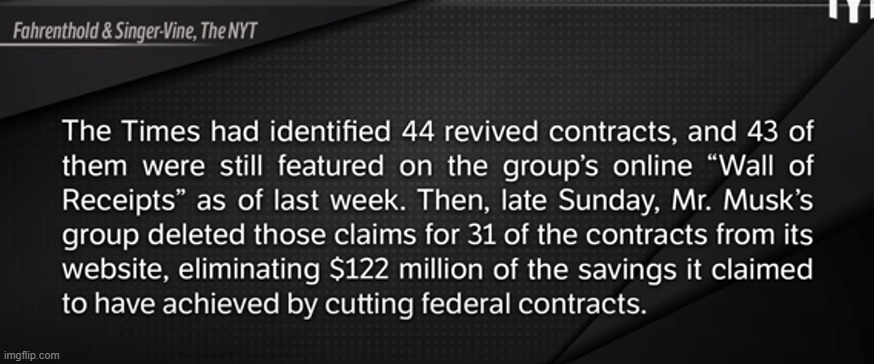

Now, one thing I do know, with 1.5 years (I was wrong in the OP they have 1.5 years to come up with these "savings"), even if they "save" all that money we will still be deficit spending and increasing debt. DOGE does nothing to pay down debt.

While I find this kind of thing entertaining, and enjoy posting their number, I think that they are largely spinning their wheels with no forward momentum. I also like that we who are not takers get to point out that anyone looking to end government waste and excess will be met with anger and hatred from the left.