To illustrate the inflow of money into commodity trades, but he did not explain how it works and why it leads by itself into price increase. This could be obvious for some people but I feel that I need to explain, just in case.

There is a fundamental difference between stock market and commodity market. You can buy and hold any stock as long as the company exists (when company goes belly up you can say the stock “expired”).

In opposite, at the commodity market everything expires and is temporary. There are two markets - spot and futures. At spot market you buy for quick delivery of physical, at futures market you buy the contract for future delivery. Every single physical is traded at the market either for immediate or future delivery and every future contract is eventually replaced by physical delivery.

When the “investment” money come to markets they either buy at spot (unlikely) or buy futures (more likely), because why would they stockpile physical if they don’t really need it? If they buy futures they need to roll-over those futures every month to avoid the delivery of physical. If the amount of “investment” money at the market is constant they just re-invest into new futures at every expiration and that does not affect prices.

However, it the amount of “investment” money is growing, the amount of futures sold at every expiration is replaced by increased amount of new futures, i.e. the demand for futures is fundamentally increasing. But that’s not all.

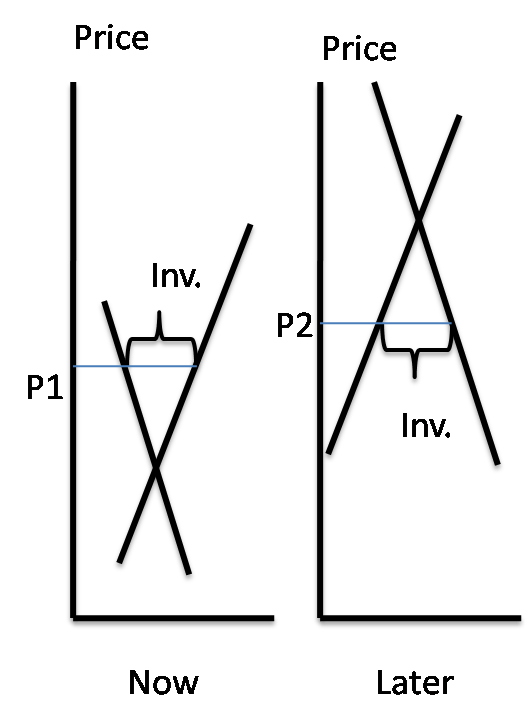

The final consumers of every commodity are expecting the futures to trade at discount to current spot price, because the commodity seller is getting his money early, which is effectively a credit. The discount of futures to current spot price is normal and is just the cost of money. However, if new “investors” are interfering with prices that could elevate the price of futures comparing to spot. The reaction of final consumers is simple: they will buy less futures and buy more physical. When they buy more physical then they really need the inventory grow and prices go up.

Thus, the inflow of “investment” money into commodities markets automatically lead into price increases. There is no other way, this is just simple math. The inventory build-up is not so transparent as it could, because the producers of intermediate goods may take more crude goods than they really need and produce more output. It might be cheaper to stockpile processed goods, they probably take less space and are less perishable. But the producers of final goods may also expect the prices to increase and produce more of final goods than the market demands. So the stockpiling of products may happen at all levels and in different countries, so it is impossible to properly track and quantify those excesses.

Russ Winter chart shows the constant inflow of funds “invested” into commodities. I take “investment” into quotes because of the fundamental difference. While at stock markets investment means ownership of something permanent, at commodities markets “investment” means some traders are stuck with futures between producers and consumers. Every month, those traders transfer this temporary ownership to consumers and buy more from producers, which leads into price increase and inventory build-up.

I think, unless the demand is growing faster than those capital inflows, we have a classic financial pyramid that is fed by inflow of new money. At one point in future this process will be exhausted and the money will start to flow out. That means that at expiration time the sellers will dominate buyers and final producers will rather burn out inventories then buy new stuff. That will make commodities to go down at the quite impressive speed. When it will happen? I have no idea

http://theroxylandr.wordpress.com/2008/04/08/how-commodity-speculation-works/

http://theroxylandr.wordpress.com/2008/04/08/how-commodity-speculation-works/